2025-2026 Predictions: Top 10 Data, Al and Cybersecurity Use Cases in Sport

In today’s digital, data-driven economy, the entire sports value chain is being reimagined through accelerated adoption of cloud-native ecosystems and GenAI tools.

This is dramatically lowering the barriers to entry for new, disruptive digital offerings.

The pressure for realising new digital revenue streams, for securing investment for innovative hyper-personalised sports fan engagements and compelling content creation, and rollout of digital ‘smart venue’ physical infrastructure at stadiums, will continue to intensify.

The deployment of digital streaming platforms has fundamentally shattered the historical constraints of linear sports media distribution and created limitless opportunities for redefining how sports properties attract and retain a global digital sports fan base.

The intensifying social media competition for Gen Z & Alpha attention is no longer limited to traditional sports properties; it extends to influencers on Instagram and YouTube platforms, live gaming streams on Twitch, and algorithm-based, personalised content offerings on TikTok. This younger, digitally native audience are less inclined to sit through linear, lengthy, live sporting events and instead seek almost instant, immersive, ‘sound-bite’ sporting experiences.

Sport is now a digital, personalised entertainment business.

Consumers today have a wide array of entertainment options spanning various genres, leading to a shift in expectations. Digital viewers expect content to be tailored to their preferences, and if it fails to captivate, they will show their disinterest by choosing other options.

Digital loyalty remains transient.

This ruthless market shift has prompted sports properties and broadcasters to focus on becoming data-centric organisations and to fully embrace artificial intelligence (AI) to create innovative digital fan experiences, and broaden the reach of their unique content.

This is fundamentally transforming the way sports properties, athletes, fans, journalists, and sponsors experience sport.

Growth rate in the global sports industry is forecast to double from 2024 onwards.

The global sports market has historically grown steadily at 3-3.6% CAGR for the period 2014 – 2023. The rise in womens’ sports, increasing valuations of sports rights deals and huge growth in social media adoption and consequential athlete empowerment have contributed to this consistent growth. The rise in digital streaming platforms contributed significantly to 2023 growth, whilst the increasing dynamic of private equity (PE) investment in sports properties in North America, Europe and India will continue from 2024 onwards.

As sports properties accelerate their data-driven ambitions and AI-augmented immersive fan experiences, the demand for private equity investment to fund technology transformation and stadium infrastructure ecosystem upgrades will continue to be highly relevant.

The shift to leverage digital and data is fuelling the global sports market growth.

CAGR growth is forecast to double from 2024 onwards, growing boldly at a consistent 6.1% CACR. Key market disruptors contributing to this sustainable growth include:

★ Sports properties rapidly improve their data maturity and network cybersecurity postures to become data centric organisations in order to monetise their 1st party data from their social media followers.

★ Digital immersive fan engagements and personalised AI-powered sports broadcasting

★ The market entry of Netflix and Apple platforms into live sports streaming hits mainstream across North American leagues (NFL, NBA, MLB, NHL, MLS) and Europe (soccer, cricket, rugby).

★ Connected smart venues with private 5G / WIFI 7 connected infrastructure ecosystems become mainstream at all sports properties to drive enhanced immersive fan experiences and new revenue streams.

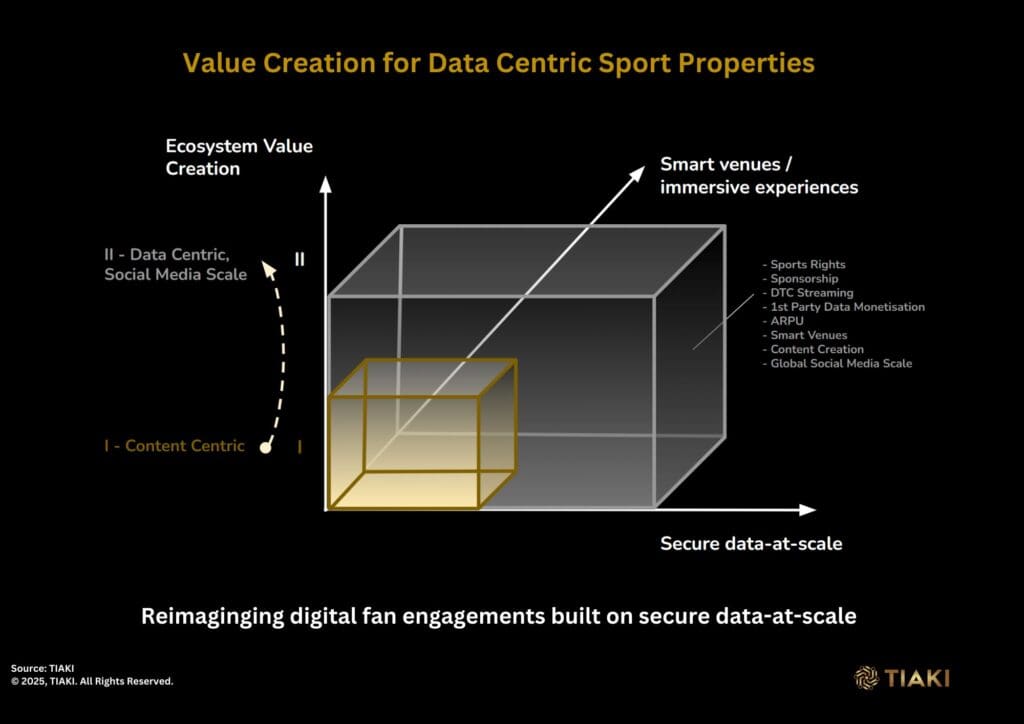

Data centricity shifts to front and centre as media rights value plateaus.

The sports industry is approaching an inflexion point where the over-reliance on media rights as the key driver for long-term revenue growth is waning. The market has reached a saturation point with its existing offerings and must now consider new data-driven digital levers and ecosystem partnerships for growth. However, there are significant hurdles in the short term to achieve value creation due to the lack of data and digital maturity in the industry.

All actors in the dynamically changing sports value chain will need to become data centric organisations to compete ‘off the field’ in an increasingly crowded global marketplace for sports fan engagement and loyalty.

‘Secure data-at-scale’ will be paramount to even enter the race.

Winning the battle for customer lifetime value (CLV)

The primary digital sports fan relationship across Customer Lifetime Value (CLV) is a highly contested space. Traditionally, sports franchises, sports broadcasters, and sports sponsors have all played a significant role in engaging with fans digitally.

The landscape is now shifting with the emergence of Netflix, Amazon Prime and Apple entering the market. They are all vying for fans’ attention and loyalty, and are looking for innovative ways to engage with them in a digital-first world.

The fundamental value lever is a deep, interactive, loyal relationship with sports fans to drive new monetisation and customer lifetime value (CLV) the sports digital ecosystem.

A pivotal shift is needed in the fragmenting global sports industry, otherwise irrelevancy will materialise. The future lies in dynamic content creation and secure data-at-scale which will reimagine unique value creation in the sports platform ecosystem.

Sports properties need to become data centric organisations.

Many sports properties are challenged to leverage 1st party data from their fan base of social media followers for monetisation and deeper, insightful engagement purposes. A customer lifetime value (CLV) centric mindset is not in place. This data immaturity is failing to meet expectations of fans, sponsors and private equity investors and also potentially undermines negotiation power in future sports media rights deals.

A recent 2024 survey of UK sports properties leadership highlights the challenge:

★ 88% of C-suite sports executives admit they do not have a data strategy integrated into their business decision making1.

★ 50% concede to commercialising less than 10% of their known audience2.

The data challenge is broader than simply how to improve harvesting existing 1st party data. A retailing data-driven personalisation mindset is needed to leverage 1st party data with anonymised 2nd party data from global players such as Google Audiences and synthetic data generation to create large volumes of sports fan personas for algorithmic learning. Only then will highly accurate, hyper-personalization marketing campaigns become credible for targeting new potential sports fans and assisting in retaining and engaging existing fans.

Data-driven insights which enable the sports franchise to recognise, in advance, that a specific element of their fan base is at risk of disengagement, and then proactively address this with personalised campaigns to neutralise the churn risk, should become standard. This data-centric shift needs to be embraced quickly by the sports industry to drive stickiness, international growth and monetisation outcomes.

Data-at-scale becomes critical for success.

Leading sports franchises and clubs are looking to redefine data-driven, digital fan experiences via their own platform ecosystems, own brand direct-to-consumer (DTC) streaming subscriptions and compelling content creation. This is fundamentally based on managing vast quantities of 1st party data and likely 2nd party and synthetic data volumes to create unique hyper-personalisation experiences to their existing and potential target sports fans.

Sports organisations will need to grow their data strategy maturity to have the correct governance and guard rails in place to deliver this ‘data-at-scale’. The challenge, however, does not stop here. Crucially, this data must be secure. Leading organisations are recognising this vital requirement and are now starting to deploy market best practice Secure Access Service Edge (SASE) solutions to minimise their cybersecurity data risk.

AI-augmented cybercriminals smell opportunity in private equity invested sports franchises with billion dollar rights deals.

As the AI-augmented cybercriminals ramp up the volume and complexity of their data breach attacks, the cyber threat and consequential risks to new 2024 sporting business models have never been higher.

The industrialisation of the cybercriminal ecosystem has created a 79% increase in ransomware attacks in the last 12 months3.

More worryingly, the complexity and speed of the attacks are increasing significantly due to the deployment of AI tools by the cybercriminal.

The cybercriminals are opportunistic. They hunt for soft targets that are digitally and data immature, where there is significant investment from private equity and sports rights stakeholders to justify the criminals’ demands for high ransomware payouts following a data breach theft. The NBA’s $76 billion and NFL’s $111 billion sports rights deals, with increasing private equity investment and an explicit business goal to target data-driven fan growth in international markets, demonstrates exactly why the sports industry is becoming an attractive target for ransomware data breach attacks.

The cybercriminals are now ‘AI-weaponised’ to attack enterprises that have failed to put robust network cybersecurity postures in place.

The cost of a data breach is significant. Our research suggests $6.1 million was the average cost of an enterprise data breach on 200 selected enterprises with high-end monitoring. In addition the risk of unrepairable brand damage for the sporting entity, the loss of trust from sporting fans and athletes from the theft of their personal data, and the exit of sponsors and investors, could quickly create an untenable, unrecoverable business.

80% of data breaches occurred on cloud assets in the last 12 months4.

The criticality of a robust network cybersecurity posture to protect against the cybercriminal and enable ‘data at scale’ for new monetisation opportunities, is not yet fully recognised, which is creating significant business risk in the value chain.

Secure ‘data-at-scale’ becomes the ‘lifeblood’ for growth

As Gen Z and Alpha sports fans mature, they are projected to continue their heavy online media consumption. They seek immersive, personalised experiences, powered by secure data, whether at the live game or streaming at home.

By digitally recreating live sporting events, franchises, rights holders, broadcasters and sponsors have seemingly limitless creative possibilities.

★ 57% of sports fans report browsing the internet while tuning in to sporting events.

The demand for in-venue experience at sporting stadium events to match the fans’ streaming video experience at home is increasing dramatically.

★ 80% of Gen Z & Millennials want to watch replays or watch the live game from different camera angles on their mobile device whilst at live stadium sporting events.

★ 44% of fans look up player or team statistics during a match, a figure which increases to 51% among Gen Z audiences.

★ According to Ericsson, 47% of 5G users are engaging with augmented reality (AR) apps, 360 degree video and multi-view broadcasts, whilst their daily consumption in these formats has increased 50-60% in the last 3 years.

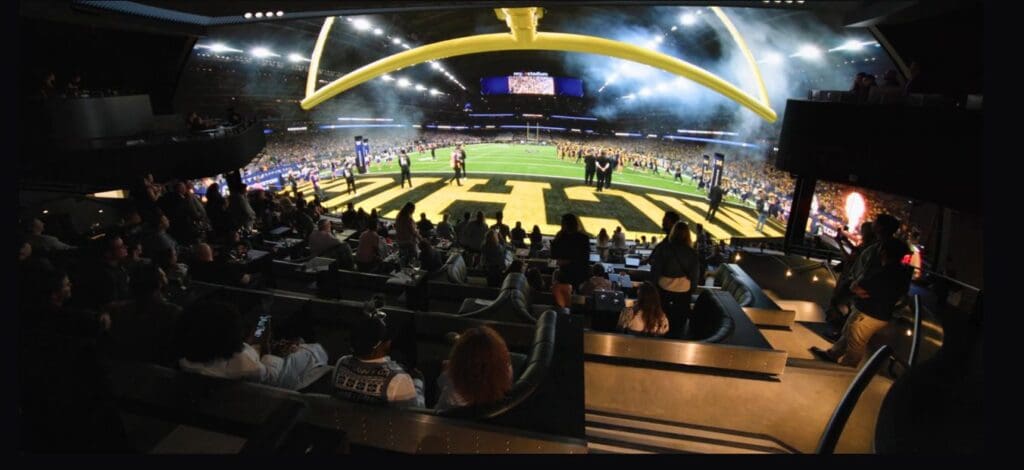

LA Clippers new Intuit Dome sets the pioneering standard in smart venue capability for the global sports industry in 2024.

Smart Venues become a foundational necessity for onsite and offsite immersive sporting experiences.

Leading sports properties are actively embracing this market shift in their race to pioneer new digital experiences to grow their fan base domestically and globally, thereby increasing their market value and negotiation power for future sports rights and sponsorship deals.

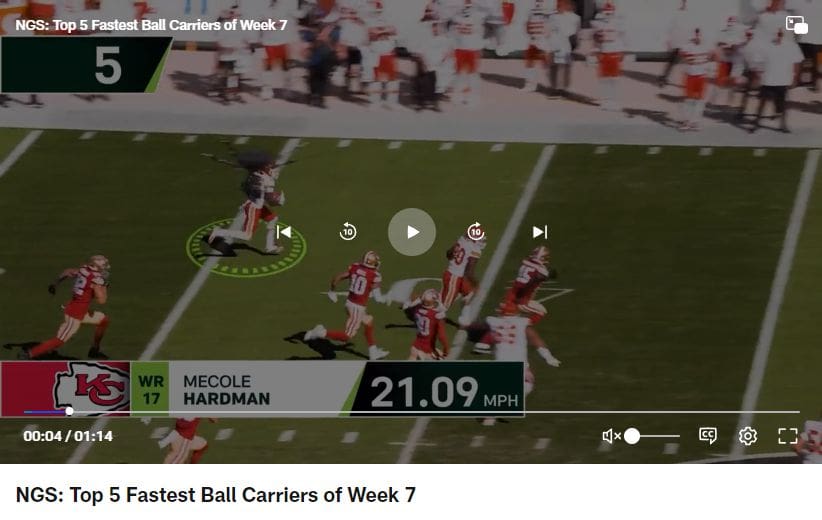

In the NFL in North America, the Los Angeles Rams have launched data-driven in-game highlights at their home Sofi Stadium, in partnership with Genius Sports AI platform (Genius IQ) and Verizon’s Private 5G SA network. The immersive experience leverages the NFL’s Next Gen Stats (NGS) including players speeds and locators, a minimap, and throwing time for quarterbacks, all displayed on Sofi Stadium’s ‘infinity screen’. The stadium infrastructure and 5G connectivity at this smart venue enable similar, shared immersive experiences for sports fans watching at any offsite location such as at home or restaurants and bars.

Immersive live digital experiences for sports fans with the NFL’s Next Gen Stats (NGS)

Robust, data-driven market growth upside but an increasingly lethal threat landscape emerges in 2025.

Market dynamics suggests CAGR growth at 6.1% looks to be robust, and has significant upside potential, if the correct fundamental investment priorities in data, AI and cybersecurity are implemented across the global sport ecosystem.

The cybercriminal will continue to industrialize and embrace AI to exploit weaknesses in the sports value chain and target the vast sums of investment capital in the ecosystem for financial gain.

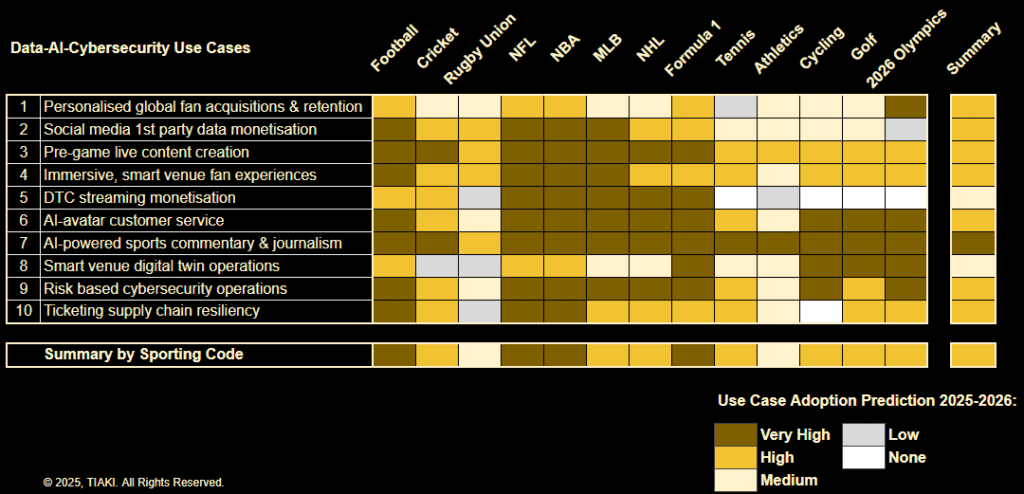

Top 10 data, AI and cybersecurity use cases across 13 sporting codes.

Our analysis of the top 10 use cases firstly considered the selection of sporting codes. Although this became a short list of 13 specific sporting codes, we do believe that our guidance is applicable to other sporting codes which have not been listed.

Factors which influenced the selection of the chosen sporting codes included:

★ Global footprint of leagues, robust sports fan following and active sports participation across diversified age groups

★ Level of private equity and private capital investment.

★ Social media growth amongst sports fans in the last 5 years and forecast growth potential.

★ Athlete empowerment in the specific sporting code.

★ Existing engagement of Gen Z and Alpha sports fans and potential for expansion into international new markets.

★ Existing sports media rights profile and likely entry of new actors with appetite to buy media rights.

★ Governing body governance footprint and potential to guide on data, AI and cybersecurity for the future.

★ Extensive, high quality stadiums footprint and potential for migration to smart venue adoption.

★ Potential for accelerated domestic and international growth of women’s leagues within the sporting code.

★ Established relationships with global sports journalism.

★ Active media streaming platforms.

★ Escalating footprint of cybersecurity ransomware and data breach attacks in the last 5 years.

★ Recognition within the sporting code that 1st party data monetisation and complex supply chain issues are key challenges to resolve.

★ Recognition that Private 5G and WIFI-7 are key enablers for sports fans and media partners.

Sofi Stadium in North America leads the way in smart venue capability in NFL.

Premier League football in UK is behind North America in adopting smart venue digital capabilities but future investments could deliver significant digital impact on future business models in 2025 and 2026.

Our chosen top 10 Data-AI-Cybersecurity Use Cases matrix summary by sporting code:

North America sports leagues are pioneering innovative, immersive digital engagements with young sports fans:

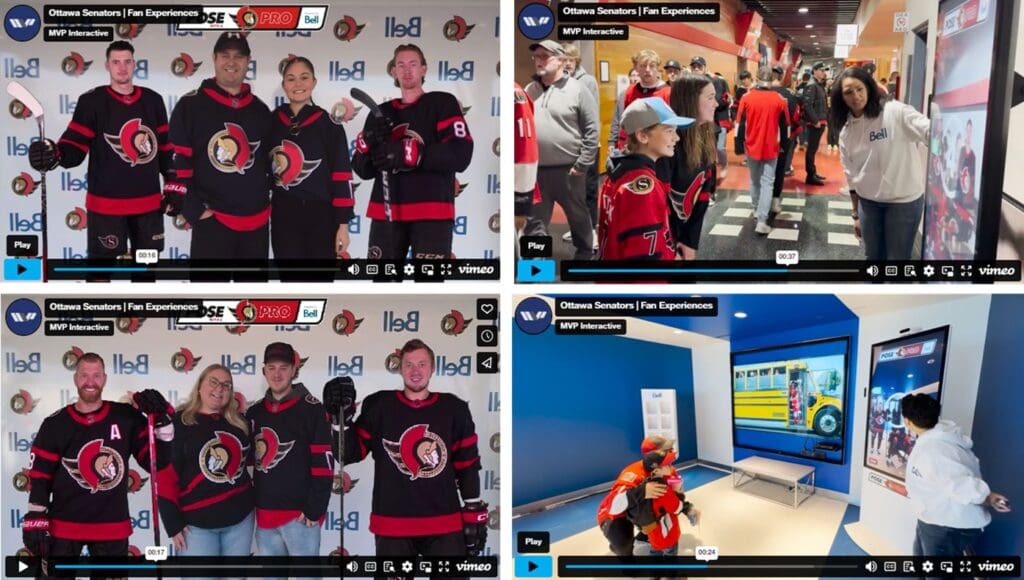

Hockey Leagues such as the NHL are already creating immersive fan experiences at the stadium. The NHL franchise Ottawa Senators are seeking deeper Gen Z and Gen Alpha engagements, prior to game time, through AR selfies with favourite players and AR jersey selfies, all instantly shared to social media creating resilience and growth in 1st party data collection.

Guidance on the top 10 use cases:

Overall, the likely uptake of data, AI and cybersecurity use cases across the chosen 13 sporting codes in the next 2 years is regarded as HIGH.

Use case summary:

1. Personalised global fan acquisitions & retention:

This use case seeks to leverage sports properties’ existing social media follower footprint of 1st party data as the basis for international fan base expansion. Data analytics profiling of this 1st party data, combined with additional data sources, such as anonymised 2nd party and synthetic data generation, creates large volumes of sports fan personas for AI algorithmic learning. This creates highly accurate, hyper-personalised marketing campaigns, which should provide relevant, localised and authentic interactions for prospect new sports fans and assist in retaining and engaging existing fans to reduce the risk of churn and deepen a compelling long term relationship with the fan base.

Recent research suggests that only 50% of enterprises have access to and leverage synthetic data modelling, so this is a huge untapped data source capability to assist competitive differentiation when seeking to cut through the noise of a highly crowded social media landscape to gain relevance and authenticity to potential and existing sports fans.

Data-driven insights which enable the sports franchise to recognise, in advance, that a specific element of their fan base is at risk of disengagement, and then proactively address this with personalised campaigns to neutralise the churn risk, should become standard. The data must be secure.

Personalised global fan acquisitions & retention adoption, across 13 sporting codes, is assessed to be HIGH.

2. Social media 1st party data monetisation:

This seeks to leverage the vast amounts of 1st part data as an asset primarily focussed on monetisation growth. To date, the sporting industry has failed to deploy effective retailing strategies to deliver new revenue streams at scale from their primary data asset.

Lack of success is backed up by recent 2024 research in the UK sports market:

- 88% of C-suite sports executives admit they do not have a data strategy integrated into their business decision making.

- 70% of sporting organisations do not have a digital strategy.

- 50% of sports executives admit to commercialising less than 10% of their known 1st party data.

There is however upside. Fans are increasingly bypassing traditional media channels and engaging directly with sports franchises through social media, streaming platforms, and other digital channels. In order to keep up with this shift, sports franchises that become content origination focused, prolific social media actors and experts at leveraging their 1st party data, have high growth potential for data monetisation. The data must be secure. This means adopting a customer lifetime value (CLV) mindset, deploying cybersecurity market best practice and creating engaging, relevant content that resonates with fans and drives personalised interaction and loyalty.

Social media 1st party data monetisation adoption, across 13 sporting codes, is assessed to be HIGH.

3. Pre-game live content creation:

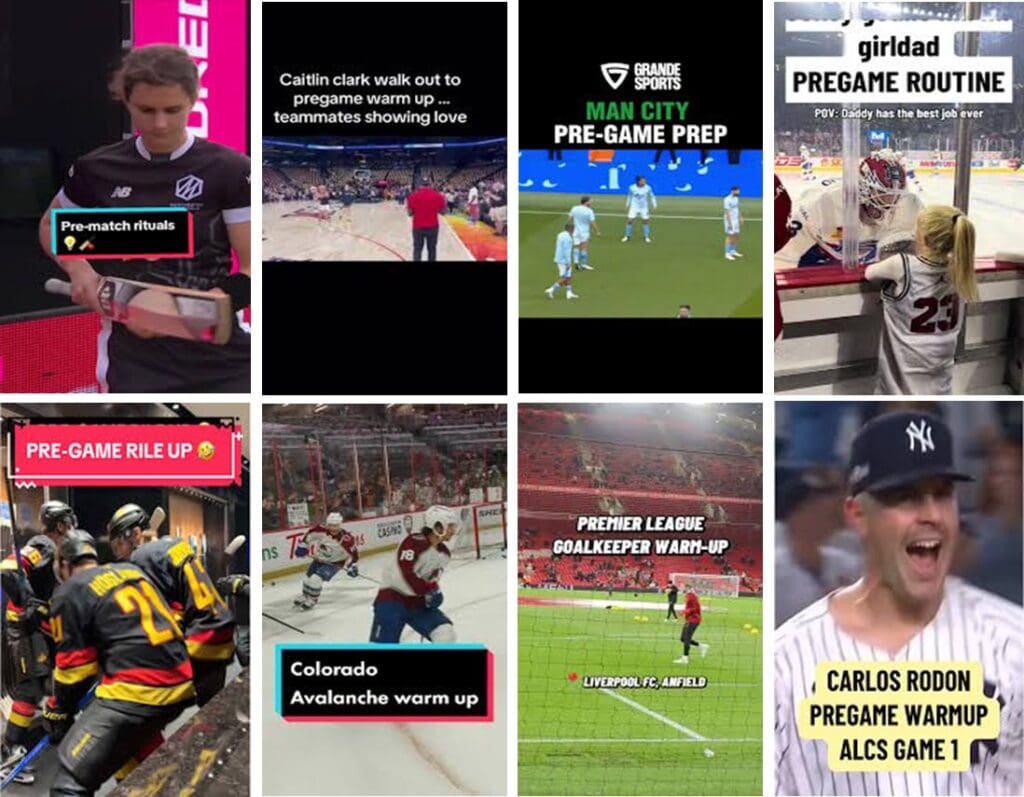

This use case is already being deployed successfully with innovative, creative content in the UK’s Premier League football, in The Hundred cricket and in North America’s NFL, NBA, MLB and NHL, with some of the leading franchise clubs distributing via TikTok and YouTube.

TikTok pre-game live content examples across multiple sporting codes

Pre-game live content video fees on TikTok is now shifting towards mainstream’ on TikTok and YouTube for multiple sporting codes.

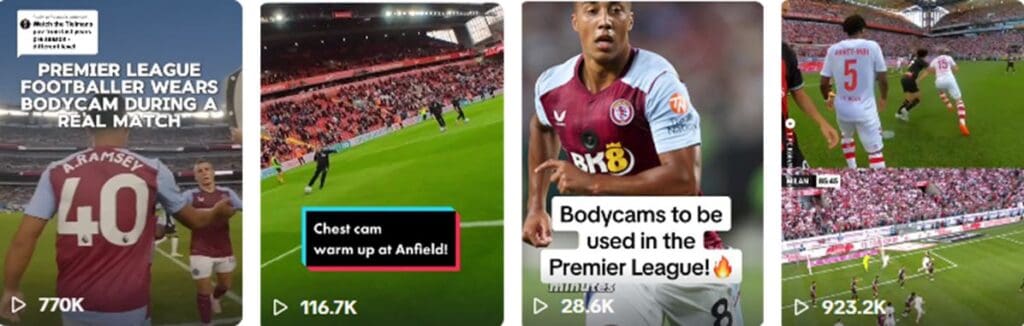

The pace of innovation in the Premier League is already setting new boundaries with TikTok live microphone commentaries from leading players during the warm ups now available and recently the emergence of bodycam video feeds from players competing in the game. This could significantly reimagine the way sports media is distributed into the future.

TikPre-game live commentary during warm ups and bodycam video fees is a late 2024 disruptor which is proving highly popular with young fans and is set to disrupt media broadcasting in 2025 in multiple sporting codes.Tok pre-game live content examples across multiple sporting codes.

These examples reinforce how fans seek to bypass traditional paywall media channels and engage directly with sports franchises and their favourite athletes through social media and streaming platforms such as TikTok and YouTube.

The volume of sports content, including pregame content, viewed on YouTube increased by 30 per cent over the past 12 months according to research published in Dec’24. In the US, sports fans watched 35 billion hours of sports on YouTube in Q2’24, a 45% increase year-on-year.

Sports properties should look to become agile, content creating, prolific social media actors, in order to grow and harvest their 1st party data for new digital monetisation opportunities. These new pre-game live video feeds are proving highly popular with the young sports fan audiences which should help to drive further personalised, authentic interactions and loyalty. The 1st party data must be secure.

Pre-game live content creation adoption, across 13 sporting codes, is assessed to be HIGH.

4. Immersive, smart venue fan experiences:

More than 70% of sports executives view diversifying content offerings beyond live events, enhancing live media experiences, and customising content and recommendations as crucial strategies to boost fan engagement5.

In 2024 real use cases at scale began to be successfully deployed:

1. In Cycling at the Tour de France in July’24, digital twin and real-time AI-powered insight assets helped to create ‘the world’s largest connected stadium’ – spanning 3,500km in rural France connected by Private 5G SA, WIFI 6 & Satellite.

2. In Tennis at Wimbledon in July’24, IBM and The All England Lawn Tennis Club (AELTC) deployed an enhanced, i digital experience with a new feature called “Catch Me Up.” This utilizes IBM’s generative AI technology to provide AI-generated summaries for each singles player, detailing their last match performance and upcoming challenges, making it easy for fans to track player progress. “Catch Me Up” allows users to personalize their experience by adding favorite players. It offers pre-match analysis, predictions, and post-match highlights, along with links to live streaming and video content, creating a more immersive experience for fans.

3. At the UK Golf Open 2024, the digital fan experience was redefined using generative AI, digital twins, avatar support and private 5G to modernise golf’s oldest championship.

4. To power the Paris 2024 Olympics connectivity, the telco operator Orange ran a private 5G Standalone (SA) network throughout Paris. This provided capacity across 32 spots and 120 official sites across the city. It also powered the Olympics Broadcast Service (IBC), which produced 11,000 hours of live TV. To guarantee the best, immersive, real-time footage, more cameras were deployed in Paris 2024 than at any previous Games. The Opening and Closing Ceremonies alone featured almost 500 cameras, including 200 wireless smartphone cameras located on ships and boats forming a procession along the River Seine.

5. In the NFL, the Los Angeles Rams have launched data-driven in-game highlights at their home Sofi Stadium, in partnership with Genius Sports AI platform (Genius IQ) and Verizon’s Private 5G SA network. The immersive experience will leverage the NFLs Next Gen Stats (NGS) including players speeds and locators, a minimap, and throwing time for quarterbacks, all displayed on Sofi Stadium’s ‘infinity screen’. The infrastructure and 5G connectivity at Smart Venues such as Sofi Stadium enable similar, shared immersive experiences for sports fans watching at any offsite location such as at home or restaurants and bars.

6. In the NBA, the league is collaborating with immersive technology expert Cosm to revolutionize live games into 8K ‘shared reality’ experiences, giving participants a virtual, compelling shared experience of being present in an NBA arena. Cosm’s innovative technology aims to connect the physical and virtual realms by digitally reconstructing a stadium and mirroring its atmosphere within a specialized ‘offsite’ sports viewing, similar to a wide screen cinema atmosphere. Every aspect of this experience is designed to immerse fans in the feeling of attending a live event, featuring stunning visuals, genuine food and beverage selections, and various venue elements, including merchandise stands.

The Cosm widescreen, shared reality, immersive AR experience for watching live games in North America6

Smart venue use cases connect physical and virtual operational assets, often involving a large ecosystem of partners that have access to the sports property stadium networks and leverage multiple data sources in real-time. This creates digital vulnerability with a new, complex extended attack surface that is vulnerable to data breaches and weaknesses in the extended 3rd party ecosystem (eg ticketing or point of sale payment systems or even lighting / heating SCADA infrastructure systems). Therefore, an effective use case ‘at scale’ requires effective data governance and data operating model capability and cybersecurity best practice through platform partnerships, deployed across the entire sports property environment. This new reality, in digital vulnerability, is not just about the theft of sensitive data but extends to financial fraud, manipulation of competition outcomes, and even the safety of players and fans in stadiums through disruptions of physical, connected stadium infrastructure.

Cricket, rugby and football leagues continue to be ‘behind the curve’ in Europe in this use case area and requires leadership focus, investment prioritisation in data, networks and cybersecurity capability through partnerships and talent recruitment to create the foundation for success.

Immersive, smart venue fan experiences adoption, across 13 sporting codes, is assessed to be HIGH.

5. Direct to Consumer (DTC) streaming monetisation:

In North America:

- The NFL has embraced DTC streaming and launched its own NFL+ streaming platform. Sports fans can now watch all games available in their local market, plus access radio, podcasts, and team-created content with NFL+. The compelling case for NFL to pursue its own branded DTC streaming platform is due to the historical fragmentation of content distribution in the US market. Streaming platforms now dominate with 41% of total viewing consumption led by YouTube, with Amazon Prime showing the highest monthly growth in Sep’24, thanks to Thursday Night Football and with DirecTV for Sunday regional games. Cable represents 26.1% and Broadcast 22.6% of total viewing consumption. With such a complex, fragmented platform landscape for sports fans to navigate to watch their favourite NFL team, the risk of content dilution and disengagement increases. Hence the reason for the NFL to pursue their own streaming DTC platform with NFL+.

- MLB launched its own standalone DTC offering in July’24. Home games for these 3 franchises will be broadcast in the clubs’ local areas on the MLB’s DTC streaming service. MLB are forecasting a significant positive the impact from local DTC broadcast deals. Bullish forecast suggest Cleveland Guardians broadcast reach increasing from 1.45 million households to 4.86 million (up 235%), while the Minnesota Twins’ reach will grow from 1.08 million households to 4.4 million (up 307%).

DTC disruption will inevitably continue as the fragmentation of North American sports rights across all sporting codes continues. Building a deeper, valuable relationship with sports fans in home markets and abroad will become key for the franchises. Compelling content creation and DTC streaming services are likely to be part of the future solution. However these two items alone will not be enough for long term value creation with sport fans. North American franchises have not yet ‘cracked the code’ for growing their fan base at scale in international markets.

In Europe:

- To reach their global audience, Manchester City have 8 million subscribers on their YouTube channel and developed their own media production capability to provide exclusive behind the scenes content and full match replays via their City+ DTC streaming subscription service. Uniquely, Manchester City have focussed heavily on their WhatsApp channel which now has more than 254 million members compared to 148 million followers consolidated across Instagram, X, YouTube, TikTok and Facebook. The multiple platform ecosystem at Manchester City shares a high amount of content covering photos, players interviews and behind the scenes. The WhatsApp channel is used to heavily promote the DTC City+ streaming subscription service.

Direct to Consumer (DTC) streaming monetisation adoption, across 13 sporting codes, is assessed to be MEDIUM.

6. AI-avatar customer service:

AI-powered Avatars have been successfully deployed in 2024 in multiple sporting codes with likely accelerated adoption across more and more sporting codes in 2025. The technology is proven, the demand from Gen Z and Alpha fans is now clearly recognised, which drives more data-driven personalised engagements with sports fans for stickiness and further future monetisation opportunities. The data powering the Avatar algorithms must be secure against the cybercriminal.

AI-powered Avatars have been successfully deployed in multiple sporting codes to drive improved personalised customer service, more immersive digital fan engagements and to create deeper knowledge amongst the fan base. Examples included Tour de France digital customer service, Golf’s personalised digital twin of Jack Nicklaus and ESPN’s Avatar for pre-game discussions and enlightening analytics fun on college football in USA7.

In Golf, the digital avatar of Jack Nicklaus, “Digital Jack”, provides a virtual interactive experience and also offers personalised game-improvement advice. Golfers playing on Nicklaus-designed courses will be able to use their smartphones to seek his insights on how to tackle specific holes. Additionally, he will share information about the courses he has designed.

“You’ll be able to stroll around a PGA Tour event or your local golf course, take out your phone, and hold it up as if you’re Face Timing Jack. The app will display Jack walking on the tee, allowing you to engage with him and ask questions.” 8

Manchester City and Puma letting fans design the future team kit using AI-powered platform9

Additionally, in Dec’24 pushing the AI boundaries further beyond customer service, in a first for the world of soccer, Manchester City and sportswear brand Puma launched an innovative kit design platform powered by artificial intelligence that will give fans the opportunity to create the club’s official third kit for the 2026/27 season. Yet another pioneering way in data and AI are being used to grow more 1st party data and engage more immersively with sports fans. This AI-powered kit design initiative is likely to accelerate adoption across multiple sporting codes in 2024. The foundational data behind it must be secure.

AI-avatar customer service adoption, across 13 sporting codes, is assessed to be HIGH.

7. AI-powered sports commentary & journalism:

Generative AI has been increasingly being integrated into innovative broadcasting workflows in 2024. Successful deployments include:

- In Major League Soccer (MLS) collaborated with Camb.AI to deploy AI-powered real-time translations of English audio commentary into French, Spanish, and Portuguese, while preserving the original speaker’s voice and tone. Additionally, Camb.AI is partnering with Eurovision Sport to automatically translate live commentary from French to Portuguese during the 2024 World Athletics U20 Championships. What is financially attractive about this functionality is the ability to scale real-time commentary, in multiple languages, across many matches or sporting codes at the same time without have to incur impractical hiring costs.

IBM’s generative AI technology is set to create entirely new real-time audio commentary for highlights at prestigious events like Wimbledon and the Masters, pushing the boundaries of AI’s role in sports broadcasting even further.

NBC’s Paris Olympics personalized VIP sports commentary with an AI-powered, audio doppelganger

At the Paris 2024 Olympics in July, NBC Peacock successfully pioneered the delivery of personalized VIP sports commentary with an AI audio doppelganger from one of North America’s iconic sports commentating icons. The NBC Streaming service offered a unique fan experience where any live Olympic event could be selected with commentary delivered with Al Michaels AI generated voice10. The AI algorithms are powered by vast amounts of data which must be secure..

AI-powered sports commentary & journalism adoption, across 13 sporting codes, is assessed to be VERY HIGH.

8. Smart venue digital twin operations:

Digital twin deployments in sport have already been successfully deployed to support innovative fan engagements at the Tour de France in July’24 and at the America’s Cup in Sep’24. Private 5G SA or WIFI-7 is a critical network foundation to enable large amounts of data to be successfully deployed for digital twin applications. The data must be secure which supports the case for an effective Secure Access Service Edge (SASE) strategy and framework implementation.

Digital Twin solutions have been successfully deployed in the private sector for a number of years to assist with operational performance outcomes and ‘what if’ operational simulations. As new smart stadium construction builds accelerate in North America and Europe, the market is even exploring digital twin simulations into the architecture design process to improve seat occupancy for revenue generation, fan movement flow pre-game and post-game and minimise health & safety risks. For existing stadiums the ability simulate physical and digital infrastructure with a digital twin instance can significantly improve maintenance performance and reduce opex costs.

Smart venue digital twin operations adoption, across 13 sporting codes, is assessed to be MEDIUM.

9. Risk-based cybersecurity operations:

As the AI-augmented cybercriminals ramp up the volume and complexity of their data breach attacks, the cyber threat and consequential risks to new 2024 sporting business models have never been higher. The cybercriminal is now ‘AI-weaponised’ to attack enterprises that have failed to put robust network cybersecurity postures in place.

The C-suite can pivot confidently to new sporting digital business models with an effective Secure Access Service Edge (SASE) strategy. A SASE strategy is fundamental in shifting to data-driven, AI-augmented network cybersecurity operations with the correct deployment of cybersecurity vendor partners to ensure that all areas of the sporting ecosystem across physical, digital, OT, data, AI and third parties are robustly secure and aligned to a risk-based posture defined by the organisation leadership.

Target state operations aims to shift operational focus to high end, AI-augmented decision making, whilst automating typically manual, commodity operational tasks. This strategic alignment and prioritisation of risk-based controls, based on business understanding, are essential components of a SASE strategy to effectively manage network cybersecurity risks at the C-suite level.

A comprehensive SASE strategy will impact all areas of the sporting value chain. This can be effectively delivered through an holistic SASE consulting engagement which will consider technology, operational processes, talent, leadership, risk and business impacts to assess current state, future target state and how to transform.

Risk-based cybersecurity operations adoption, across 13 sporting codes, is assessed to be HIGH.

10. Ticketing supply chain resiliency:

The supply chain cybersecurity risk is becoming a major concern across all industries. The cost of a third-party supply cyber breach is typically 40% higher than the cost to remediate a direct internal cybersecurity breach. 99% of Global 2000 companies are directly connected to a breached vendor in their supply chain. This suggests a similar significant exposure risk for sporting entities.

Furthermore, the limited talent pool of in-house network cybersecurity resources lacks awareness of the emerging AI-augmented threats, whilst operating legacy systems not designed for cybersecurity best practice. This further exacerbates the risks.

The increasing cybersecurity supply chain risks facing sports properties and broadcasters requires a proactive and strategic approach to cybersecurity and increased prioritisation. In 2025 there will be increased adoption of C-suite sponsored SASE strategies to enable a more mature, data-driven, risk-based approach to supply chain risk and improve the overall security posture. This will not only help to protect their assets and maintain the trust of their viewers but also drive innovation and growth in the rapidly evolving sports ecosystem.

Ticketing supply chain resiliency adoption, across 13 sporting codes, is assessed to be HIGH.

Key takeaways for the sporting codes:

1. Football:

Football, as the leading dominant global sport, has huge potential to benefit from a future, more pronounced data-centric culture due it’s leadership in the social media footprint of fans where leading clubs have almost 400 million followers. Monetisation of 1st party data assets is huge if data leadership is championed by active executive leadership at football clubs and national leagues.

Football’s overall adoption profile is VERY HIGH.

2. Four North America Leagues:

The four North America leagues provide some of the leading pioneering examples of data, AI and cybersecurity adoption for the sports industry, including instant AR selfies with favourite players and AR jersey selfies to trigger fan engagement prior to game time. The early smart venue, immersive real-time outcome fan experiences are providing enormous optimism. The challenge remains in how these leagues can leverage this capability to grow their global fan bases and monetisation opportunities outside of North America.

NFL and NBA lead the way with an overall adoption profile of VERY HIGH.

MLB and NHL are not far behind with an overall adoption profile of HIGH.

3. Formula 1:

Formula 1’s partnership with AWS has pioneered some early examples of real-time, immersive fan experiences which has led to a new wave of energy and fan adoption, particularly amongst Gen Z and Alpha profiles. The key is to now expand data, AI and cybersecurity use cases beyond the AWS silo and grow new monetisation opportunities.

Formula 1’s overall adoption profile is VERY HIGH.

4. Cricket:

Cricket has significant potential for growth with global fan social media followers approaching 50 million fans for some IPL clubs and an ever increasing appetite for private equity investment in multiple markets. Data centricity maturity and cybersecurity capability at leading clubs and at the governing body layer remains challenging and needs to be improved.

Cricket’s overall adoption profile is HIGH.

Cricket leagues such as India’s IPL, Australia’s Big Bash and UK’s The Hundred have the potential to provide the foundation to reimagine digital, immersive experiences for Gen Z and Alpha fans and renegotiate media rights deals and sponsorship. The necessary investments in data, AI, cybersecurity and smart venues are not yet in place to deliver on this potential.

5. Cycling:

Cycling has pioneered digital twin adoption, immersive fan experiences and digital avatar customer experiences in the last 2 years, particularly at the top tier Grand Tour European professional races Giro d’Italia, Tour de France, and Vuelta a España. At the Tour de France in July’24, digital twin and real-time AI-powered insight assets helped to create the world’s largest connected stadium – spanning 3,500km in rural France connected by 5G SA, WIFI 6 & Satellite.

Cycling’s overall adoption profile is HIGH.

6. 2026 Winter Olympics:

The 2026 Winter Olympics seeks to build on the success of the summer Paris 2024 Olympics where Private 5G deployed by Orange Business, AI-augmented sports journalism from Peacock and personalised, data driven engagements and immersive applications proved a huge success. Momentum is clear and the benchmark for success reaching new expectations.

2026 Olympics’ overall adoption profile is HIGH.

7. Golf:

Golf’s strategic partnerships with AWS and NTT data is starting to deliver compelling examples of AI-augmented, data driven fan experiences. Golf’s digital revolution is fueled by extensive deployment of real-time cameras – digital twin – private 5G deployments, AI avatars and AI-powered commentary is reimagining the golf experience for fans at the premier golfing championships.

Golf’s overall adoption profile is HIGH.

8. Tennis:

Tennis offers pioneering data-driven, immersive fan experiences at the grand slam events including AI-powered personalized player stories, AI-powered live match analysis including win probability predictions and AI-augmented detailed journalistic commentary within minutes of a match result.

Tennis’ overall adoption profile is HIGH.

9. Rugby:

Rugby is starting to show signs for data-driven fan engagement during live matches such as the Vodafone Ireland Rugby application. However, the malaise around the lack of appetite from media rights buyers, the profound financial fragility of many tier 1 rugby clubs in all major markets and the lack of investment in stadium infrastructure risks hindering rugby’s ability to rapidly meet Gen Z and Alpha fan expectations. Optimism remains that potential injection of private equity investment wil start to ‘change the game’ but diversity and appeal to younger sports fans remain challenging issues.

Rugby’s overall adoption profile is MEDIUM.

10. Athletics:

Athletics continues to struggle to compete in the global social media landscape. There remains optimism that Michael Johnson’s Grand Slam Track is the start of revolutionising global athletics. However investment is needed to reimagine digital engagements with Gen Z & Alpha athletics fans via own platform ecosystems, smart venues and immersive live content creation. Athletics is at the start of this journey and risks fading away in an increasingly crowded sports market.

Athletics’ overall adoption profile is MEDIUM.

Conclusion:

The aim of this analysis is to provide business leaders in sport with guidance on how data, AI and cybersecurity use cases can deliver tangible value realisation at scale into the business across 13 sporting codes. By focusing on value quantification and ROI output, executive leadership can take informed decisions on their future investment priorities, growth appetite and risk management across data, AI and cybersecurity in the sports ecosystem.

1 Only 2% of UK sports properties expecting major media rights growth in next five years – SportsPro (sportspromedia.com)

2 Only 2% of UK sports properties expecting major media rights growth in next five years – SportsPro (sportspromedia.com)

3 Orange Cyberdefense Executive Navigator 2024: Research-based cybersecurity insights to drive smart business decisions

4 PaloAlto Networks Unit42_ASM_Threat_Report_2023

5 2023 Global Sports Survey | Altman Solon

6 The Experience | Cosm

7 ESPN creates new AI-powered football analyst that could be the future of watching live sport | TechRadar

8 This AI-powered Jack Nicklaus ‘twin’ will allow fans to interact with the legend

9 Man City Design New Goalkeeper Kit With Ai!

10 Peacock’s Personalized Olympics Recaps to Feature Al Michaels | NBC Insider

About the Author:

David Andrew

Founder & Managing Partner

www.tiaki.ai

david.andrew@tiaki.ai

David is the Founder & Managing Partner at TIAKI, a niche consulting practice helping executive leadership in sport make confident, informed decisions on their risks, investments and business outcomes powered by secure ‘data-at-scale’. He collaborates with bold and determined leaders in the sports ecosystem to define their data, AI and cybersecurity strategies to deliver sustainable value.

David’s vision for TIAKI is to empower sports franchise CEOs, leadership teams, sports media broadcasters and investors in the global sports industry with strategic advisory frameworks to deliver secure, pioneering digital fan experiences and new ecosystem business models to achieve breakthrough returns.

David has over 20 years of strategy and technology enabled business transformation experience, providing consulting expertise in cloud native technologies, data strategy, digital business enablement and cybersecurity strategy. He is passionate about helping talented leadership teams succeed in securely growing their differentiated business models in the data-driven, digital sports economy.

Based in Stockholm, David previously worked for IBM Consulting, EY, Accenture Strategy and Orange Business. He studied Chemistry at Durham University and holds an MBA from Trinity College, Dublin Business School.

Copyright © 2025 TIAKI.

All rights reserved. TIAKI and its logo are registered trademarks of TIAKI.

Search