Game Change: How Smart Venues and SecureData-at-Scale Will Redefine Value Creation

The sports value chain has been reimagined by digital, data and AI

In today’s digital, data-driven economy, the entire sports value chain is being reimagined through accelerated adoption of cloud-native ecosystems and GenAI tools. This is dramatically lowering the barriers to entry for new, disruptive digital offerings.

The pressure for realising new digital revenue streams, for securing investment for innovative hyper-personalised sports fan engagements and compelling content creation, and rollout of digital ‘smart venue’ physical infrastructure at stadiums, will continue to intensify.

The deployment of digital streaming platforms has fundamentally shattered the historical constraints of linear sports media distribution and created limitless opportunities for redefining how sports properties attract and retain a global digital sports fan base.

The intensifying social media competition for Gen Z & Alpha attention is no longer limited to traditional sports properties; it extends to influencers on Instagram and YouTube platforms, live gaming streams on Twitch, and algorithm-based, personalised content offerings on TikTok. This younger, digitally native audience are less inclined to sit through linear, lengthy, live sporting events and instead seek almost instant, immersive, ‘sound-bite’ sporting experiences.

Sport is now a digital, personalised entertainment business.

Consumers today have a wide array of entertainment options spanning various genres, leading to a shift in expectations. Digital viewers expect content to be tailored to their preferences, and if it fails to captivate, they will show their disinterest by choosing other options. Digital loyalty remains transient.

This ruthless market shift has prompted sports properties and broadcasters to focus on becoming data-centric organisations and to fully embrace artificial intelligence (AI) to create innovative digital fan experiences, and broaden the reach of their unique content.

This is fundamentally transforming the way sports properties, athletes, fans, journalists, and sponsors experience sport.

Market Disruptors Impacting the Global Sports Industry

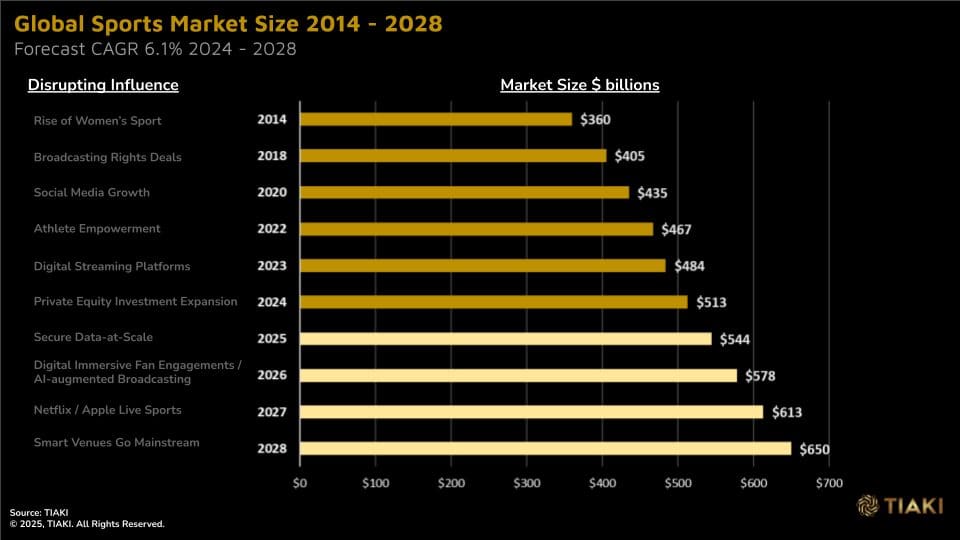

The global sports market has historically grown steadily at 3-3.6% CAGR for the period 2014 – 2023. The rise in womens’ sports, increasing valuations of sports rights deals and huge growth in social media adoption and consequential athlete empowerment have contributed to this consistent growth. The rise in digital streaming platforms contributed significantly to 2023 growth, whilst the increasing dynamic of private equity (PE) investment in sports properties in North America, Europe and India will continue from 2024 onwards.

As sports properties accelerate their secure ‘data-at-scale’ ambitions and AI-augmented immersive fan experiences, the demand for private equity investment to fund technology transformation and stadium infrastructure ecosystem upgrades will continue to be highly relevant.

The shift to leverage digital and data is fueling the global sports market growth from 2024 onwards. CAGR growth is forecast to double from 2024 onwards, growing boldly at a consistent 6.1% CACR. Key market disruptors contributing to this sustainable growth include:

★ Sports properties rapidly improve their data maturity and network cybersecurity postures to become data centric organisations in order to monetise their 1st party data from their social media followers.

★ Digital immersive fan engagements and personalised AI-powered sports broadcasting .

★ The market entry of Netflix and Apple platforms into live sports streaming hits mainstream across North American leagues (NFL, NBA, MLB, NHL, MLS) and Europe (soccer, cricket, rugby).

★ Connected smart venues with private 5G / WIFI 7 connected infrastructure ecosystems becomes mainstream at all sports properties to drive enhanced immersive fan experiences and new revenue streams.

Over a 14 year period, the global sports market will almost double from $360 billion in 2014 to $650 billion by 2028. High growth in the next 3 years is fundamentally driven by the pivotal shift to digital and secure data-at-scale.

Digital vulnerabilities and unprecedented cybersecurity risks

However, this disruptive digital shift is often taking the C-suite at sporting organisations into uncharted territory. Extensive digital, AI / data and network cybersecurity expertise amongst C-level and boardroom executives will become key enablers for success. This cannot be delegated, as this capability is becoming so deeply embedded in the new digital business models, and is often a challenging knowledge area for C-suite and boardroom leaders.

★ 90% of CEOs are worried their organisation will be a victim to a catastrophic cyber attack by 20251. Yet, paradoxically:

★ 95% of CEOs wrongly believe that compliance is the key driver of their Cybersecurity Strategy2.

★ 44% of CEOs do not view Cybersecurity as a strategic enabler to the business3.

Consequently, the necessary enterprise investment priorities may be misguided, placing the new digital sporting business models at risk. Sporting entities will continue to shift to cloud-based solutions, yet cloud remains the dominant attack vector for the cybercriminal.

In the last 12 months, 80% of data breaches occurred on cloud assets4.

Cyber threats appear in various forms, including attacks on spectator experiences, ticketing systems, and online scams aimed at stealing customer or athlete data and financial information. Plus the digital evolution of sporting venues, characterised by interconnected networks and devices, has exposed stadium infrastructure to new vulnerabilities.

This new reality, in emerging digital vulnerability in the sports industry, is not just about the theft of sensitive data but extends to financial fraud, manipulation of competition outcomes, and even the safety of players and fans in stadiums through disruptions of physical, connected stadium infrastructure.

Industrialisation of the AI-powered cybercriminals will fuel digital headwinds

As the AI-augmented cybercriminals ramp up the volume and complexity of their data breach attacks, the cyber threat and consequential risks to new 2024 sporting business models have never been higher. The industrialisation of the cybercriminal ecosystem has created a 79% increase in ransomware attacks in the last 12 months5.

The cybercriminal is now ‘AI-weaponised’ to attack enterprises that have failed to put robust network cybersecurity postures in place. The cost of a data breach is significant. Our research suggests $6.1 million was the average cost of an enterprise data breach in 2022 based on 200 selected enterprises with high-end monitoring6. In addition the risk of unrepairable brand damage for the sporting entity, the loss of trust from sporting fans and athletes from the theft of their personal data, and the exit of sponsors and investors, could quickly create an untenable, unrecoverable business.

Secure ‘data-at-scale’ becomes the ‘lifeblood’ for growth

The criticality of a robust network cybersecurity posture to protect against the cybercriminal and enable ‘data at scale’ for new monetisation opportunities, is not yet fully recognised, which is creating significant business risk in the value chain.

As Gen Z and Alpha sports fans mature, they are projected to continue their heavy online media consumption. They seek immersive, personalised experiences, powered by secure data, whether at the live game or streaming at home.

By digitally recreating live sporting events, franchises, rights holders, broadcasters and sponsors have seemingly limitless creative possibilities.

★ 57% of sports fans report browsing the internet while tuning in to sporting events7.

★ The demand for in-venue experience at sporting stadium events to match the fans’ streaming video experience at home is increasing dramatically.

★ 80% of Gen Z & Millennials want to watch replays or watch the live game from different camera angles on their mobile device whilst at live stadium sporting events8.

★ 44% of fans look up player or team statistics during a match, a figure which increases to 51% among Gen Z audiences9.

★ According to Ericsson, 47% of 5G users are engaging with augmented reality (AR) apps, 360 degree video and multi-view broadcasts, whilst their daily consumption in these formats has increased 50-60% in the last three years10.

Smart Venues become a foundational necessity for onsite and offsite immersive sporting experiences

Leading sports properties are actively embracing this market shift in their race to pioneer new digital experiences to grow their fan base domestically and globally, thereby increasing their market value and negotiation power for future sports rights and sponsorship deals.

In the NFL in North America, the Los Angeles Rams have launched data-driven in-game highlights at their home Sofi Stadium, in partnership with Genius Sports AI platform (Genius IQ) and Verizon’s Private 5G SA network11. The immersive experience will leverage the NFLs Next Gen Stats (NGS)12 including players

speeds and locators, a minimap, and throwing time for quarterbacks, all displayed on Sofi Stadium’s ‘infinity screen’. The infrastructure and 5G connectivity at Smart Venues such as Sofi Stadium enable similar, shared immersive experiences for sports fans watching at any offsite location such as at home or restaurants and bars.

The Genius AI platform (Genius IQ) has also been deployed successfully for immersive fan engagement experiences at Smart Venues in Europe, in the Danish League.

This requires tracking cameras to be deployed, automatically capturing millions of positional data points on players and the ball multiple times per second. The huge volume of data is then ingested into the AI platform to create compelling, new immersive content for fans, coaches and broadcasters.

For example the sports broadcaster Viaplay now offers a unique, pioneering AI-augmented experience called ‘Manager Mode’ where live tracking insights feed directly into the real-time broadcasting experience. Similar to NFL live action insights include player minimaps and IDs, shot speeds and much more13.

Similar compelling immersive experiences are now available in the German Bundesliga in partnership with AWS with data-driven graphics for real-time broadcasting feeds.

Up to 20 smart cameras are deployed at each stadium to create up to 3.6 million incidents per game which feed into the ‘Bundesliga Match Facts’ to provide shot speed, attacking zones, and goalkeeper efficiency that can be used by the sports media broadcasters. It is this vast amount of data in large language models (LLMs) that forms the foundation to create interactive immersive experiences with sport fans, coaches and players.

These opportunities did not exist previously and require a pioneering new mindset in how to monetise, govern and secure this new, emerging dynamic.

Critically, the LLM data must be secure and integrated across the broader ecosystem to enable new business models to scale towards fans, broadcasters and sponsors.

The LA Clippers new Intuit Dome redefines expectations for smart venue experiences

In Los Angeles, The Clippers new $2 billion arena hosted its first NBA game on 5th Nov’24. This signalled The Clippers strategic intent to pioneer and differentiate their home fan experience with one of the most technology advanced connected stadiums, thanks to their owner Steve Ballmer’s seemingly ‘bottomless pit’ of investment budget. The smart venue experience has some unique features which we are likely to see repeated in future stadium upgrades in North America and Europe in the next 18 months.

Intuit Dome features include:

★ Toilets to fan ratio of 1:15 which is 3 times more than the average NBA arena. The clippers want you watching the game or buying merchandise rather than queuing in toilets.

★ All of the meal retailing outlets have the same menu to minimise decision-making, and default digital, contactless checkout via grab-and-go (similar to the Amazon Go store concept) to get fans back into their seats as soon as possible.

★ The Clippers took inspiration from the other sporting codes visiting 100 venues around the world. This included soccer (Tottenham, Liverpool in the Premier League and Dortmund in the Bundesliga) and cricket (IPL) to create the ultimate fan experience for Clipper fans at one end of the arena. This consists of 51 rows of uninterrupted seating from floor to ceiling and is only available to home fans wearing The Clippers apparel. This enables a ‘wall of noise’ during matches creating immense experiences both for the fans and The Clippers players. Tickets are priced at a moderate $32/game to attract the young, student fan base.

★ All seats are heated and offer massage settings and USB ports for charging mobile devices for the connected, digitally native fan base.

★ Advanced stats and analytics are available to fans throughout the game via a huge, double-side 360-degree scoreboard.

Immersive real-time AI-powered insights, for competitors and fans, with ‘smart connected stadiums’ in the Bay of Barcelona or Fields of France

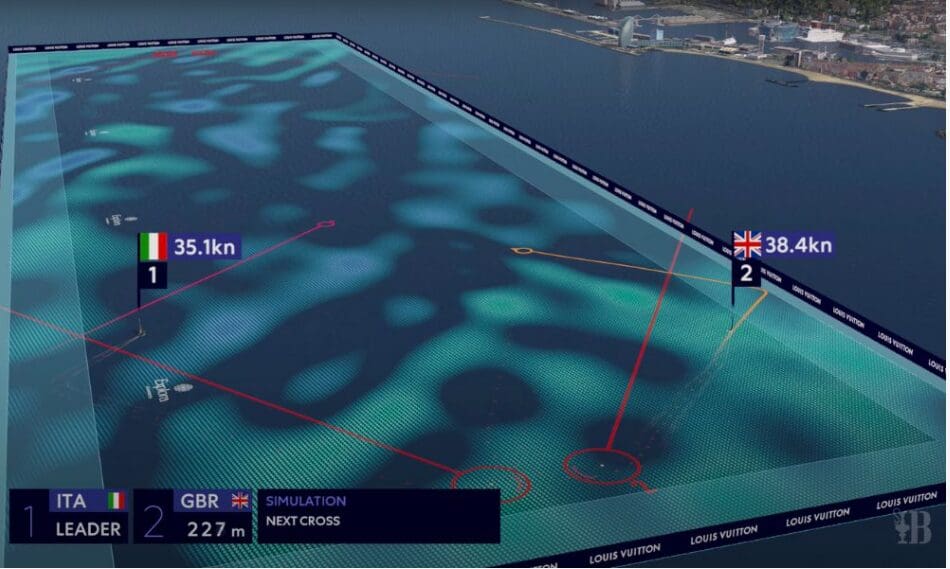

At the Americas Cup in Barcelona in Sep’24, immersive real-time AI-powered insights for competitors and fans is an expected mainstream offering, powered by Private 5G SA.

A real-time ‘VIRTUAL EYE’ application creates a digital replica of all aspects of the race. Insightful, data-driven visualisations brings the race to life for fans, officials, and broadcasters, which also includes digital real-time commentary. For the competitors, each boat can produce more than 3,000 data points within half a second, which is sent to engineers onshore for analysis in real time14.

At the Tour de France in July’24, digital twin and real-time AI-powered insight assets helped to create ‘the world’s largest connected stadium’ – spanning 3,500km in rural France connected by 5G SA, WIFI 6 & Satellite15.

In light of this trend, more than 70% of sports executives view diversifying content offerings beyond live events, enhancing live media experiences, and customising content and recommendations as crucial strategies to boost fan engagement16. Hyper-personalization and AI-augmented digital offerings will become key for competitive edge.

Smart venue business models require data centric organisations

Building an effective 1st party data strategy for digital fan growth is becoming foundational for success for leading sports franchises and clubs. One only needs to look at other sectors, such as Financial Services and Telco industries, to understand how they have spectacularly failed to develop deep meaningful, personalised relationships with their customers, despite sitting on vast quantities of transactional and location-specific conversation data. This reflects an inability to leverage data-at-scale from their legacy silos.

FC Barcelona remains one of the leading global football club brands on social media with 335 million followers. However, their recent €280 million sponsorship deal with Spotify failed to meet the music streaming brand’s expectations. The sponsorship collaboration provided Spotify with less than 1% of Barcelona’s followers in actual first party data for monetisation opportunities.

This highlights the reality gap which exists at many sporting organisations which is their inability to leverage 1st party data from their fan base of social media followers for monetisation and deeper, insightful engagement purposes. A customer lifetime value (CLV) centric mindset is not in place. This data immaturity is failing to meet expectations of fans, sponsors and private equity investors and also potentially undermines negotiation power in future sports media rights deals. Our earlier observations reinforce this reality:

★ 88% of C-suite sports executives admit they do not have a data strategy integrated into their business decision making17.

★ 50% concede to commercialising less than 10% of their known audience18.

The data challenge is broader than simply how to improve harvesting existing 1st party data. A retailing data-driven personalisation mindset is needed to leverage 1st party data with anonymised 2nd party data from global players such as Google Audiences and synthetic data generation to create large volumes of sports fan personas for algorithmic learning. Only then will highly accurate, hyper-personalization marketing campaigns become credible for targeting new potential sports fans and assisting in retaining and engaging existing fans.

Data-driven insights which enable the sports franchise to recognise, in advance, that a specific element of their fan base is at risk of disengagement, and then proactively address this with personalised campaigns to neutralise the churn risk, should become standard. This data-centric shift needs to be embraced quickly by the sports industry to drive stickiness, international growth and monetisation outcomes.

Secure data-at-scale becomes critical for success

Leading sports franchises and clubs are looking to redefine data-driven, digital fan experiences via their own platform ecosystems, own brand direct-to-consumer (DTC) streaming subscriptions and compelling content creation. This is fundamentally based on managing vast quantities of 1st party data and likely 2nd party and synthetic data volumes to create unique hyper-personalisation experiences to their existing and potential target sports fans.

Sports organisations will need to grow their data strategy maturity to have the correct governance and guard rails in place to deliver this ‘data-at-scale’. The challenge, however, does not stop here. Crucially, this data must be secure. Leading organisations are recognising this vital requirement and are now starting to deploy market best practice Secure Access Service Edge (SASE) solutions to minimise their cybersecurity data risk.

The Emergence of SASE

Secure Access Service Edge (SASE) is a relatively new network cybersecurity framework that combines network security functions with wide-area networking capabilities. It provides secure access to applications and data for users, regardless of their location. SASE integrates cloud-based security services with software-defined networking to deliver comprehensive cybersecurity protection. This approach helps organisations simplify their network security architecture, improve overall security posture and enable the business to deploy new digital, data-driven AI-augmented value propositions with confidence.

However, when only 30% of sporting organisations have a robust digital strategy in place19 and only 5% of enterprises have defined their SASE strategy, it seems clear that C-suite executives are not yet receiving appropriate strategic advice or taking ownership for their potential cybersecurity exposures. Correct governance guard rails and risk-based, network cybersecurity postures are not in place to protect the vast amounts of data flowing into the emerging sporting AI algorithms.

Consequently the risk of a catastrophic ransomware data breach attack has never been higher to the broad array of sporting entities in the digital sporting value chain.

European football clubs dominate the global sports social media landscape yet value remains elusive

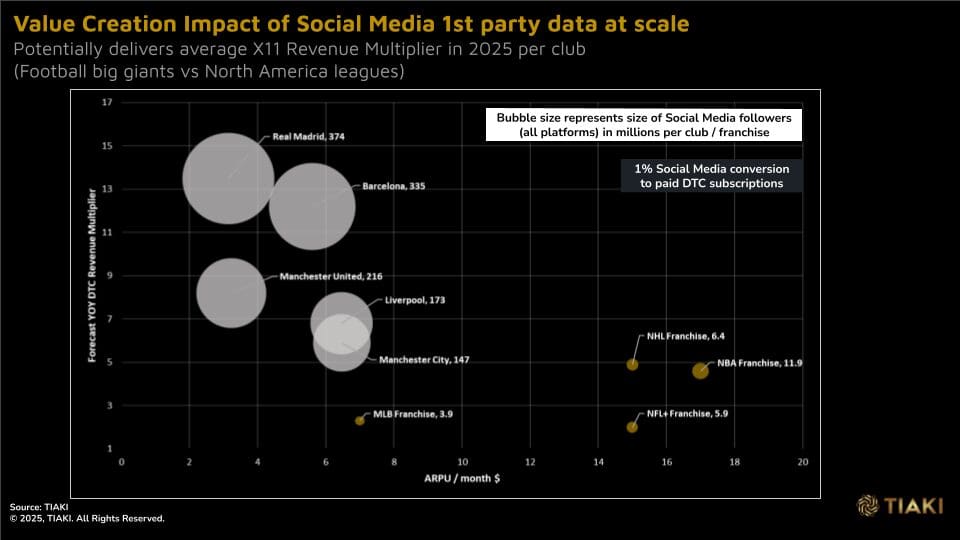

Sports franchises continue to grow their brand profiles as they become prolific social media content generators. Globally recognised European football club brands dominate social media followers compared to sporting codes in North America or cricket and rugby codes.

Reflecting a truly global fan base, the leading football club is Real Madrid with 374 million followers across Instagram, X, YouTube, TikTok and Facebook. The trend continues with FC Barcelona 335 million, Manchester United 216 million and Manchester City 148 million followers in 202420.

Yet this has not materialised in scaling new digital revenue streams from harvesting 1st party data. Let’s now examine the opportunity roadmap.

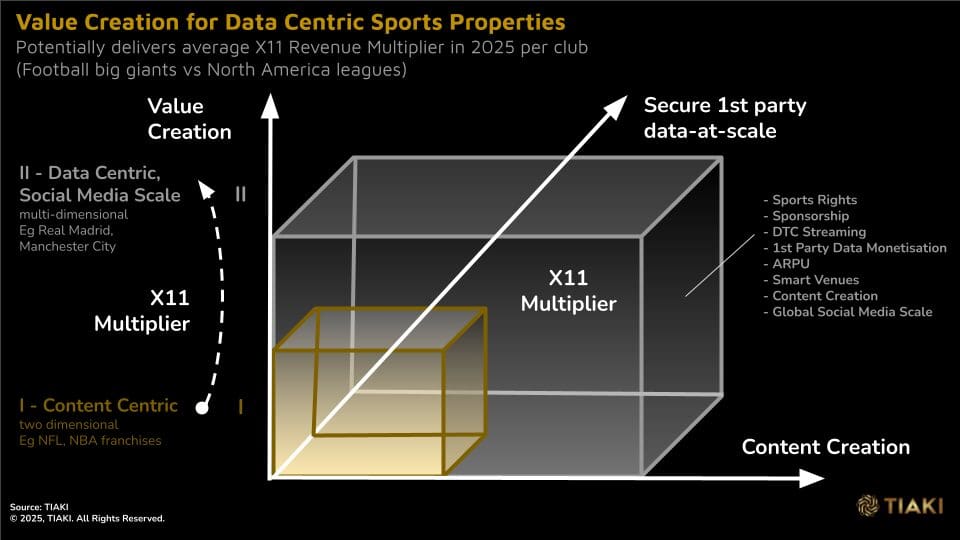

Potential for secure ‘data-at-scale’ to deliver X11 value multiplier

We analysed social media volumes across all digital platforms, DTC revenues, streaming ARPU and data maturity of the aggregate North American sports leagues, consisting of NFL, NBA, MLB, NHL franchises to create average Franchise profiles and compare them to the leading European football clubs.

Our analysis of North American franchises in the ‘big 4 leagues’ versus European football ‘big 5 giants’ indicates that 1st party data focused, CLV centric sports properties have the potential to generate, on average, a X11 multiplier in incremental value when 1st party data is scaled effectively.

Our modelling suggests that the X11 multiplier equates to an average additional $128m direct-to-consumer (DTC) revenue growth per club / franchise in the next 12 months, compared to a less data centric scaled franchise / club that had up to 3 times more base ARPU.

Our value maturity assessment of 124 aggregated teams in North America versus 5 European football giants led to two category groupings for forecast 2025 DTC revenue planning, based on ability to leverage 1st party data from social media for data-driven growth.

Group I:

High social media presence in North America, established / establishing DTC own brand revenue streams, high ARPU, 1st party CLV capability maturing, growing C-suite awareness of the criticality to drive secure data-at-scale.

Group I includes NFL, NBA, MLB and NHL franchises.

Group II:

High global social media presence, establishing DTC revenue streams, relatively low ARPU, 1st party CLV capability not yet fully recognised, emerging C-suite awareness of the criticality to drive secure data-at-scale for monetisation purposes.

Group II includes Real Madrid, FC Barcelona, Manchester United, Manchester City and Liverpool.

Assumptions:

★ Most leagues, franchises and clubs do not disclose their 2024 DTC streaming subscriber numbers so a low baseline value was assumed for all parties.

★ 2025 base DTC ARPU forecast remained static at 2024 levels.

★ Social media conversion rates for incremental growth for Groups I and II @ 1.0%. ★ Data driven churn rate reduction was assumed to be a conservative 3% improvement for Groups I and II.

Scenario Forecasting for FY25:

★ Group II data-centric, CLV focused football clubs scale to value with X11 larger DTC revenue growth outcome than Group I franchises, principally due to their ability to monetize a larger scale of their global social media fan base 1st party data.

★ On average, each Group II club had the potential to generate $128m more DTC revenue compared to individual Group I franchises. ★ This predicted outcome is forecast despite Group I franchises having, on average, approximately X3 higher base ARPU.

The C-suite can pivot confidently to new sporting digital business models and smart venue outcomes with an effective SASE strategy

The sports industry is evolving rapidly with cloud-native ecosystems and GenAI tools, to enable new digital offerings. There is an urgency for digital revenue creation, immersive content creation, and highly connected, smart venue development. Digital platforms have transformed sports media distribution, to create new opportunities for engaging a broader global audience. Competition for younger, digitally-native audiences extends to influencers and gaming, driving demand for personalized, authentic sporting experiences. This all needs data-at-scale and it must be secure against the rising threats from AI-powered cybercriminals.

A SASE strategy is fundamental in reducing cybersecurity risk by ensuring C-suite ownership and awareness on the risk to the business. It is crucial to increase top-level buy-in to address the evolving cybersecurity threat landscape, especially with the transition to digital enterprise and next-generation technologies. Many sporting organisations are ill-prepared to respond to the evolving AI-augmented threats, necessitating the need for the C-suite to elevate network cybersecurity as a senior leadership priority.

By making SASE and network cybersecurity a board-level agenda item, with proper oversight and governance, companies can align their leadership, their investment priorities for growth and commit to enhancing digital resilience against the AI-augmented cybercriminal risks, including supply chain risks, through improved cybersecurity capabilities, data maturity and gap identification.

This strategic alignment and prioritisation of risk-based controls, based on business understanding, are essential components of a SASE strategy to effectively manage network cybersecurity risks whilst providing the foundation for business value realisation.

A comprehensive SASE strategy will impact all areas of the sporting value chain. It will accelerate the successful delivery of secure ‘data at scale’ across the whole sports property organisation, including the smart venue infrastructure and the broader partner ecosystem. This can be effectively delivered through an holistic SASE consulting engagement which will consider technology, operational processes, talent, leadership, risk and business growth impacts to assess current state, future target state and how to transform towards a secure, data-led business model.

1 David Andrew: The SASE-powered C-suite

2 David Andrew: The SASE-powered C-suite

3 David Andrew: The SASE-powered C-suite

4 PaloAlto Networks Unit42_ASM_Threat_Report_2023

5 Orange Cyberdefense Executive Navigator 2024: Research-based cybersecurity insights to drive smart business decisions

6 Orange Cyberdefense Security Navigator Report 2024: Research-based cybersecurity insights to drive smart business decisions

7 2023 Global Sports Survey | Altman Solon

8 In-stadium experience | Deloitte Insights

9 How Vodafone’s AI-enhanced live match centre attracted six months of users in one week – SportsPro (sportspromedia.com)

10 A year of grand events and three fan archetypes – Ericsson

11 Verizon 5G Ultra Wideband at SoFi Stadium Superbowl | Verizon

12 NGS | NFL Next Gen Stats

13 https://www.sportspro.com/wp-content/uploads/2024/09/Denmark-Pokalen-Viaplay-video-converter.com-2.mp4

14 37th America’s Cup (americascup.com)

15 Tour de France 2024: NTT DATA is Official Technology Partner (nttdata-solutions.com)

16 2023 Global Sports Survey | Altman Solon

17 Only 2% of UK sports properties expecting major media rights growth in next five years – SportsPro (sportspromedia.com)

18 Only 2% of UK sports properties expecting major media rights growth in next five years – SportsPro (sportspromedia.com)

19 www.isportconnect.com/impact-of-digital-transformation-on-sporting-organizations/

20 Fan Engagement: football clubs consider themselves content providers. They need to start acting like it | FT Strategies – The specialist Media consultancy from the Financial Times

About the Author:

David Andrew

Founder & Managing Partner

www.tiaki.ai

david.andrew@tiaki.ai

David is the Founder & Managing Partner at TIAKI, a niche consulting practice helping executive leadership in sport make confident, informed decisions on their risks, investments and business outcomes powered by secure ‘data-at-scale’. He collaborates with bold and determined leaders in the sports ecosystem to define their data, AI and cybersecurity strategies to deliver sustainable value.

David’s vision for TIAKI is to empower sports franchise CEOs, leadership teams, sports media broadcasters and investors in the global sports industry with strategic advisory frameworks to deliver secure, pioneering digital fan experiences and new ecosystem business models to achieve breakthrough returns.

David has over 20 years of strategy and technology enabled business transformation experience, providing consulting expertise in cloud native technologies, data strategy, digital business enablement and cybersecurity strategy. He is passionate about helping talented leadership teams succeed in securely growing their differentiated business models in the data-driven, digital sports economy.

Based in Stockholm, David previously worked for IBM Consulting, EY, Accenture Strategy and Orange Business. He studied Chemistry at Durham University and holds an MBA from Trinity College, Dublin Business School.

Copyright © 2025 TIAKI.

All rights reserved. TIAKI and its logo are registered trademarks of TIAKI.

Search