Reimaging Athletics: Revenue Growth and Digital Fan Experiences in Grand Slam Track

Global athletics risks fading away in an increasingly crowded sports market

Outside of the 4 year Olympic bubble cycle, athletics has alway had to ‘punch above it’s weight’ to appeal to fans and commercial rights buyers, sponsors and investors. The situation for global athletics becomes even more challenging as sports fans expect increasingly personalised digital experiences and the sports media broadcasting market continues to fragment.

In the broader context, the emerging trend of digital disintermediation of the sports fan engagement has huge implications for all sporting codes, sports media broadcasters, social media platforms, sports sponsors and athletes.

Fans are increasingly bypassing traditional media channels and engaging directly with sports franchises through social media, streaming platforms, and other digital channels. In order to keep up with this shift,

sports properties need to become content origination focused, prolific social media actors and experts at leveraging their 1st party data. This means creating engaging and relevant content that resonates with fans and drives personalised interaction and loyalty.

For many sporting codes, the over-reliance on media rights as the key driver for long-term revenue growth is waning. The market has reached a saturation point with its existing offerings and must now consider new data-driven digital levers and ecosystem partnerships for growth. However, there are significant hurdles in the short term to achieve value creation due to the lack of data and digital maturity. To date, global athletics has struggled to create compelling fan experiences and failed to provide the framework to create global superstars with justifiable high income streams.

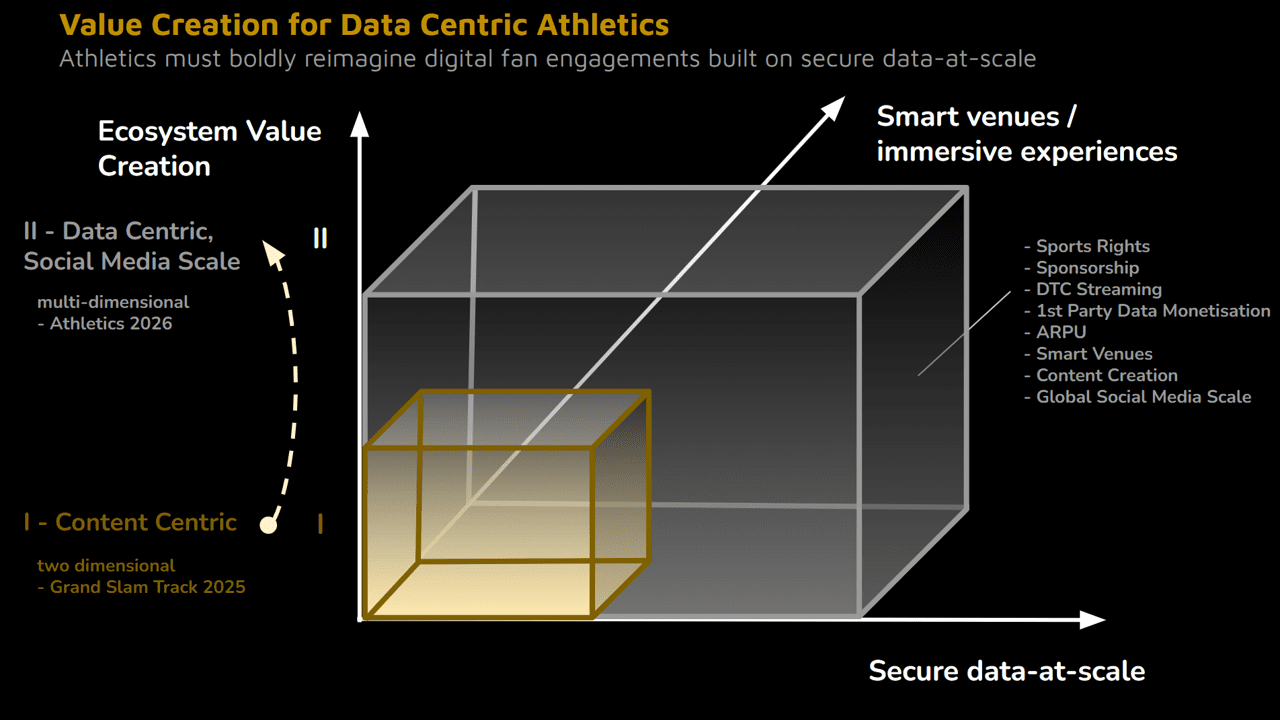

All sporting codes, including athletics, will need to become data centric actors in the sports value chain to compete ‘off the field’ in an increasingly crowded global marketplace for sports fan engagement and loyalty. ‘Secure data-at-scale’ will be paramount to even enter the race.

Athletics struggles to compete in the social media landscape

Sports franchises, across multiple sporting codes, continue to grow their brand profiles as they become prolific social media content generators. To date, athletics has been unable to compete.

Globally recognised European football club brands dominate social media followers compared to all other sporting codes in North America or cricket and rugby codes.

Reflecting a truly global fan base, the leading football club is Real Madrid with 374 million followers across Instagram, X, YouTube, TikTok and Facebook. The trend continues with FC Barcelona 335 million, Manchester United 216 million and Manchester City 148 million followers in 20241.

Cricket continues to attract a large and growing international fanbase with Chennai Super Kings in the IPL leading the club franchises with 45 million followers across Instagram, X, YouTube, TikTok and Facebook2.

Team franchises do not exist in athletics to even compete against the scale of these leading franchise social media brands. World athletics is representative of the global athletics sporting brand and has only 14 million followers across Instagram, X, YouTube, TikTok and Facebook.

Global athletics superstars remain elusive after the Paris Olympics

In Formula 1, Lewis Hamilton is the most popular Formula 1 social media star with 51 million followers across Instagram, X, YouTube, TikTok and Facebook3. This is significantly higher in followers compared to his own constructor team Mercedes which leads all the teams with 36 million followers across all social platforms, followed by Red Bull with 34 million followers.

As at Sep’24 Ronaldo had 1 billion followers across all social media platforms with Messi at 623 million followers4 and Kylian Mbappé at 150 million followers5.

The potential to leverage these leading social media sports star profiles to create unique, entertainment content for the Gen Z and Alpha segments is enormous. Gen Z sports fans are more likely to be loyal to their favourite sports stars rather than the club or franchise they are following.

This momentum has not yet been created in athletics where the best athletes and Olympics medalists, such as Mondo Duplantis, Noah Lyles, Julien Alfred and Jakob Ingebrigtsen, have each struggled to push beyond 2 million followers across all their social media platforms, even during the post Paris Olympics 2024 ‘honeymoon period’.

Grand Slam Track is the start of revolutionising global athletics

American track legend Michael Johnson has launched a new athletics league named Grand Slam Track, aiming to bring together the world’s top runners with a significant top prize of $100,000. This stands in contrast to The Diamond League, which offers a $30,000 prize for event winners across its 15 meetings. Grand Slam Track is set to kick off in April 2025, featuring four annual meetings with a prize pool of $12.6 million (£9.9m) spread across four events. The initial host cities include Miami, Philadelphia, and Los Angeles in the United States, following the opening event in Kingston, Jamaica.

Johnson’s vision for Grand Slam Track is to capitalize on the excitement and interest the sport generates during the Games every four years by bringing together the world’s fastest athletes for four three-day events annually. The goal is to provide athletes with the opportunities they desire and to showcase their talents on a prestigious stage with meaningful races.

The league’s aim is to have the best athletes competing against each other, mirroring the appeal of the world’s biggest sports. Grand Slam Track seeks to address the historical lack of adequate compensation for athletes taking risks to compete against the sport’s elite. The league’s mission is to grow the sport, increase athlete earnings, and foster innovation within the sport.

However, increased prize money and four annual meetings per year will not be ‘game-changing’ for athletics. Much more is needed …..

Reimagining digital engagements with Gen Z & Alpha athletics fans via own platform ecosystems, smart venues and immersive live content creation

A recent football fan report6 highlighted:

★ Gen Z football fan focus is not on the 90 minutes of game time on the pitch, but instead the wider entertainment football narrative, especially football documentaries.

★ Gen Z’s preferred digital platforms for content consumption are YouTube 63%, Instagram 63%, TikTok 49% and X 35%.

The same trends will apply to potential Gen Z & Alpha athletics fans. A change in mindset is needed from Athletics governing bodies and rights holders if there is ambition and investment appetite to reimagine digital engagements with young, digitally-native athletics fans.

There is urgency to boldly pursue young athletics global audiences through a hybrid platform ecosystem for content distribution. Plus the content must be personalized, immersive and shift to live streaming

-before, -during and -post actual race or event. Having a smart venue, secure ecosystem infrastructure with private 5G / WIFI7+ will be foundational for success. These bold building blocks provide the ability to reposition athletics as an attractive, interactive sporting code with high global social media following, broader value creation opportunities. It reimagines athletics as an attractive sports rights marketplace for the new, disruptive technology media rights buyers, such as Netflix, Apple+, YouTube, Facebook and emerging niche players

Athletics must start to compete for customer lifetime value (CLV)

The primary digital sports fan relationship across Customer Lifetime Value (CLV) is a highly contested space. Traditionally, sports franchises, sports broadcasters, and sports sponsors have all played a significant role in engaging with fans digitally. The landscape is now shifting with the emergence of Netflix, Amazon Prime and Apple entering the market. They are all vying for fans’ attention and loyalty, and are looking for innovative ways to engage with them in a digital-first world.

The fundamental value lever is a deep, interactive, loyal relationship with sports fans to drive new monetisation and customer lifetime value (CLV) the sports digital ecosystem.

A pivotal shift is needed for global athletics, otherwise irrelevancy will materialise. The future lies in dynamic content creation and secure data-at-scale which will reimagine unique value creation for the modern athletics sporting code.

Secure data-at-scale becomes critical for global athletics

Athletics must boldly redefine data-driven, digital fan experiences through a hybrid platform ecosystem for content distribution and compelling content creation. This is based on managing vast quantities of 1st party data and likely 2nd party and synthetic data volumes to create unique hyper-personalisation live experiences to their existing and potential target athletics fans.

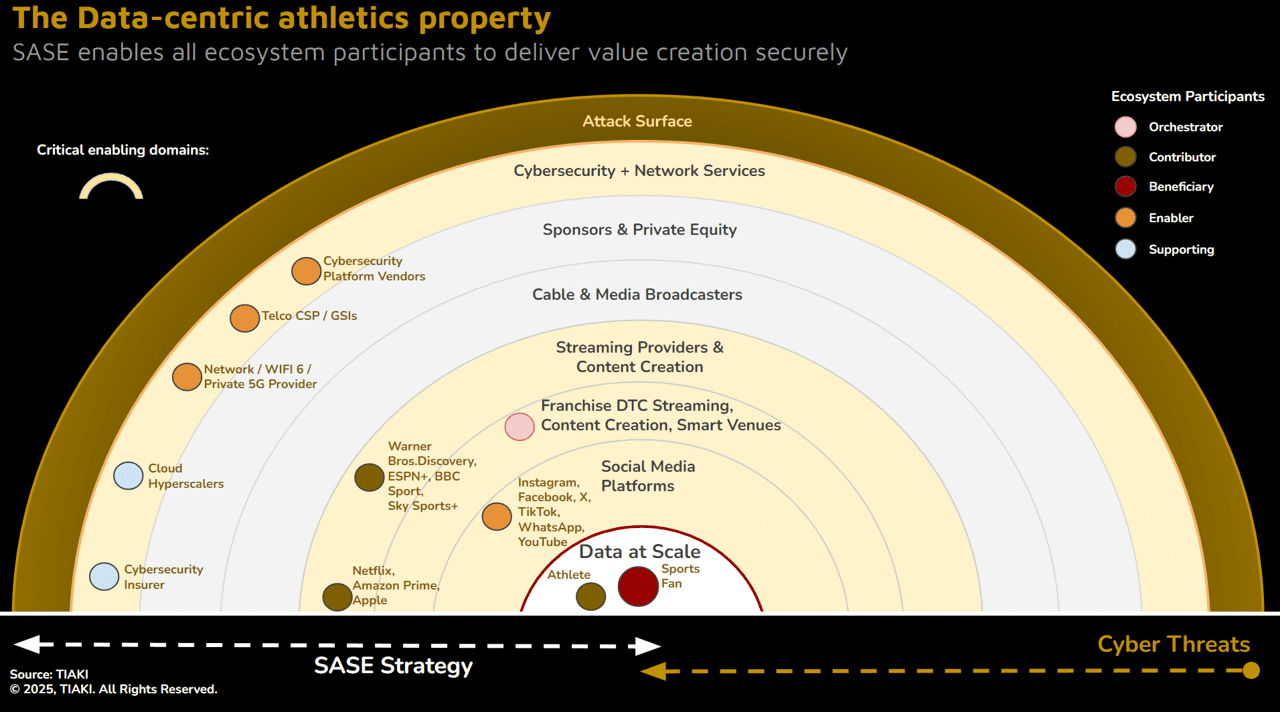

Athletics governing bodies and rights holders will need to grow their data strategy maturity to have the correct governance and guard rails in place to deliver this ‘data-at-scale’. The challenge, however, does not stop here. Crucially, this data must be secure. Leading organisations are recognising this vital requirement and are now starting to deploy market best practice Secure Access Service Edge (SASE) solutions to minimise their cybersecurity data risk.

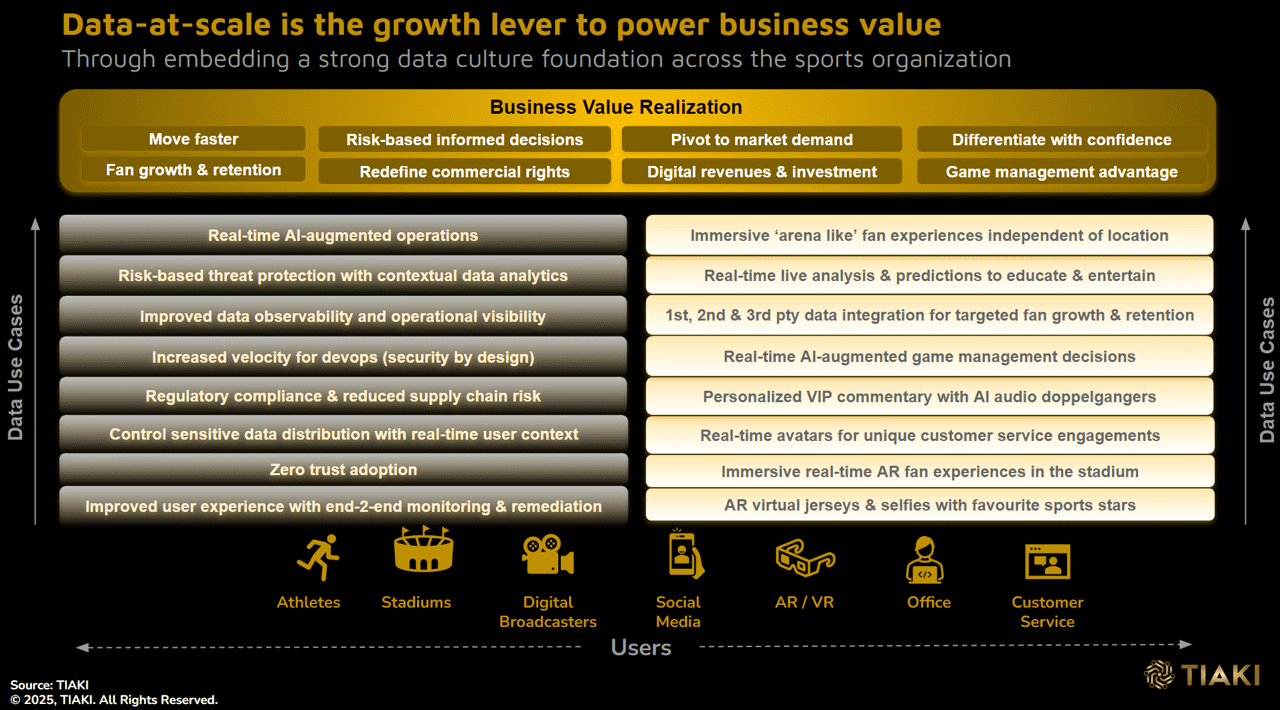

SASE can accelerate business value realization for athletics

Implementing a comprehensive SASE strategy across all aspects of an athletics organisation should not be regarded as a defensive, technology centric cost burden. With correctly deployed SASE use cases, it becomes a fundamental business enabler to catalyse revenue multiplier growth.

Below we highlight 4 business value realisation areas which benefit from a SASE data centric approach:

1. Move Faster – Pivot to Market Demand

With a robust network cybersecurity culture deployed, based on SASE, there is increased velocity for development teams to move quickly, with confidence, for their software development cycles. Security by design is embedded at the start of all development projects. This capability facilitates faster time to

market and ability to pivot to latest and potentially disruptive new market demands from fans. This enables improved differentiation and competitiveness.

2. Risk-based Informed Decisions

SASE provides the foundation for secure data-at-scale across the whole organisation. With improved data observability and greater operational visibility, decision makers are able to make better, more-informed decisions impacting the business or the network or the infrastructure or the supply chain.

Shifting to risk-based threat protection with contextual data analytics provides for a more targeted, cost efficient approach to critical operations which improves the business case profile and profitability for business use cases.

Additionally, by removing historical data silos to create secure data-at-scale, there is a greater volume of data available for algorithms to provide AI-augmented decision making to improve the quality of operational decisions. This shifts human operational focus to high-end decision making and enables manual, commodity tasks to be automated. Further improving accuracy, whilst reducing risk and cost to the business. Leading adopters can look to achieve real-time AI-augmented operations as their future target state.

3. Differentiate with Confidence – Fan Growth and Retention

Shifting to a data-driven culture to drive hyper-personalised fan engagements and content creation is becoming critically important in the increasing crowded digital sports marketplace. The ability to grow 1st party data from highly targeted fan acquisitions globally and then continue to remain relevant to this fan base to avoid churn is becoming key for long term sustainable revenue growth.

To date, most sports franchises have struggled to effectively monetize their 1st party data assets across the customer lifetime value cycle. SASE will help to accelerate this pivotal shift by catalysing the secure deployment of data for:

★ Immersive ‘arena like’ fan experiences independent of location

★ Real-time live analysis and predictions to educate, entertain and continuously engage with fans

★ The integrated use of 1st party data with anonymised 2nd party data (Google Audiences), with 3rd party data and synthetic data to create highly accurate fan personas for personalised outbound fan acquisition and retention campaigns

★ Real-time avatars for unique digital immersive experiences and customer service engagement superior expectation delivery

★ Real-time fan augmented reality (AR) fan experiences in the stadium

Additionally, a correctly deployed holistic SASE deployment will ensure that all of the above are seamlessly integrated to continue to seamlessly deliver superior data-driven athletics fan experiences.

4. Digital Revenues and Investment – Redefine Commercial Rights

Our analysis suggests that a data-centric approach with SASE can improve the conversion of social media fans to active, monthly payment subscription customers and improve the retention of these highly valuable loyal fans with deeper relationship engagements.

Athletics must actively compete, in a crowded global sports marketplace, to grow a compelling, immersive social media profile. It simply is not yet present at scale in early 2025. The potential to convert future social media athletics fans to monthly fee paying subscribers for unique content and direct to consumer (DTC) streaming services is enormous.

Retaining a large footprint of fee paying sports fans fundamentally changes the negotiation dynamic in future commercial rights deals. Without credible 1st party data assets, athletics properties have a weakened position in the dynamically changing sports value chain, particularly with increasing buying power of Netflix, Apple and Amazon Prime.

Athletics leadership can pivot confidently to new data-driven business models with an effective SASE strategy

A SASE strategy is fundamental in reducing cybersecurity risk by ensuring C-suite ownership and awareness on the risk to the business. It is crucial to increase top-level buy-in to address the evolving cybersecurity threat landscape, especially with the transition to digital enterprise and next-generation technologies. Many sporting organisations are ill-prepared to respond to the evolving AI-augmented threats, including 3rd party supply chain risks, necessitating the need to elevate network cybersecurity as a senior leadership priority.

By making SASE and network cybersecurity a board-level agenda item, with proper oversight and governance, athletics can align their leadership, their investment priorities and commit to enhancing digital resilience against the AI-augmented cybercriminal risks, including supply chain risks, through improved cybersecurity capabilities and gap identification.

This strategic alignment and prioritisation of risk-based controls, based on business understanding, are essential components of a SASE strategy to effectively manage network cybersecurity risks whilst enabling monetisation of creative content and data assets.

Conclusion: Athletics can boldly pivot to unique, immersive live fan engagements enabled by smart venues, SASE and data-centric leadership

Athletics can boldly pivot to unique, immersive live fan engagements enabled by smart venues, SASE and data-centric leadership

Without decisive change, global athletics risks facing away in an increasingly crowded sports marketplace. Today, athletics is struggling to create value in a stagnating global media rights market and increasingly competitive social media landscape. Despite a highly successful Paris 2024 Olympic spectacle, the leading global athletes have not gained significant social media followers or attracted multi-million dollar revenue streams, compared to their peers in other sporting codes. To date, the large capital investments in NFL, NBA, MLB, NHL, soccer and cricket have not flowed into global athletics.

Michael Johnson’s vision and investment activities with Grand Slam Track is the start of revolutionising global athletics. It will create more high profile events and improved, deserved prize money for the leading track athletes. However, it will not fundamentally change the dial. More needs to be done to ‘change the game’ radically.

Athletics exists in a highly digital, data-driven economy and must respond accordingly if a global, loyal athletics fan base is to be secured and media rights buyers re-energised to prioritise the sport.

Reimagining digital engagements with Gen Z & Alpha athletics fans via own platform ecosystems, smart venues and immersive live content creation will be key for bold new initiatives. Athletics should look to pioneer adoption of cloud-native ecosystems and GenAI capabilities as it seeks new digital revenue streams, invests in innovative hyper-personalised engagements with their fans and upgrades stadium physical infrastructure to become digitally connected, ‘smart venues’. This is needed to grow a highly loyal, digitally engaged fan base across the globe, willing to pay for immersive sporting experiences.

This digital data shift, will fundamentally transform the way athletes, journalists, and fans experience sport in the next 2 years. Secure ‘data-at-scale’ will be the ‘lifeblood’ of this new athletics reality.

The criticality of a robust network cybersecurity posture to protect against the cybercriminal and enable ‘data at scale’ for new monetisation opportunities, is not yet fully recognised, which is creating significant business risk. This risk can be reduced with an effective SASE strategy.

However, implementing a comprehensive SASE strategy across all aspects of an athletics operating model should not be regarded as a defensive, technology centric cost burden. With correctly deployed SASE use cases, it becomes a fundamental business enabler to catalyse profitable growth.

An effective SASE strategy provides the mechanism for athletics to:

★ To operate faster ahead of the competition with increased velocity for sports property software development teams.

★ Shift to risk-based, AI-enabled decision making to improve accuracy whilst reducing risk and costs.

★ Differentiate digital fan engagements with bold confidence to drive more effective fan acquisition and retention campaigns with improved ROI.

★ Create secure, 1st party data new digital revenue streams enabling rights holders to redefine their commercial rights negotiation dynamics with sports broadcasters and sponsors.

By shifting to become data-centric, content-generating operations, athletics has seemingly limitless creative possibilities to reimagine personalised, relevant shared experiences for their existing and prospect digital athletics fans across the globe. Data-at-scale is the lifeblood of these pioneering new ambitions. SASE adoption will ensure this data is secure for revenue growth and value creation.

1 Fan Engagement: football clubs consider themselves content providers. They need to start acting like it | FT Strategies – The specialist Media consultancy from the Financial Times

2 Which IPL Team Has Most Fans Following in 2024? (uccricket.live)

3 Most Followed Formula 1 Drivers on Social Media – Hot in Social Media Tips and Tricks

4 Cristiano Ronaldo first to hit 1bn social media followers – BBC News

5 The Mbappé Revolution: Real Madrid Signing Shakes Social Media | Blinkfire Blog

6 Docs and creator-led content essential for Gen-Z football fans | News | Broadcast (broadcastnow.co.uk)

About the Author:

David Andrew

Founder & Managing Partner

www.tiaki.ai

david.andrew@tiaki.ai

David is the Founder & Managing Partner at TIAKI, a niche consulting practice helping executive leadership in sport make confident, informed decisions on their risks, investments and business outcomes powered by secure ‘data-at-scale’. He collaborates with bold and determined leaders in the sports ecosystem to define their data, AI and cybersecurity strategies to deliver sustainable value.

David’s vision for TIAKI is to empower sports franchise CEOs, leadership teams, sports media broadcasters and investors in the global sports industry with strategic advisory frameworks to deliver secure, pioneering digital fan experiences and new ecosystem business models to achieve breakthrough returns.

David has over 20 years of strategy and technology enabled business transformation experience, providing consulting expertise in cloud native technologies, data strategy, digital business enablement and cybersecurity strategy. He is passionate about helping talented leadership teams succeed in securely growing their differentiated business models in the data-driven, digital sports economy.

Based in Stockholm, David previously worked for IBM Consulting, EY, Accenture Strategy and Orange Business. He studied Chemistry at Durham University and holds an MBA from Trinity College, Dublin Business School.

Copyright © 2025 TIAKI.

All rights reserved. TIAKI and its logo are registered trademarks of TIAKI.

Search