Secure Access Service Edge (SASE) Becomes the Ultimate Business Enabler in Sport

Growth rate in the global sports is forecast to double from 2024 onwards

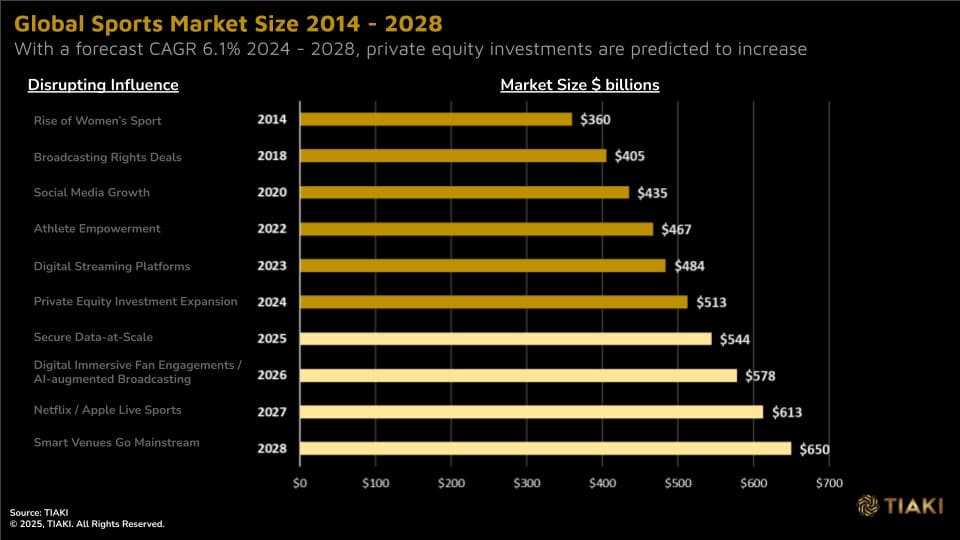

The global sports market has historically grown steadily at 3-3.6% CAGR for the period 2014 – 2023. The rise in womens’ sports, increasing valuations of sports rights deals and huge growth in social media adoption and consequential athlete empowerment have contributed to this consistent growth. The rise in digital streaming platforms contributed significantly to 2023 growth, whilst the increasing dynamic of private equity (PE) investment in sports properties in North America, Europe and India will continue from 2024 onwards.

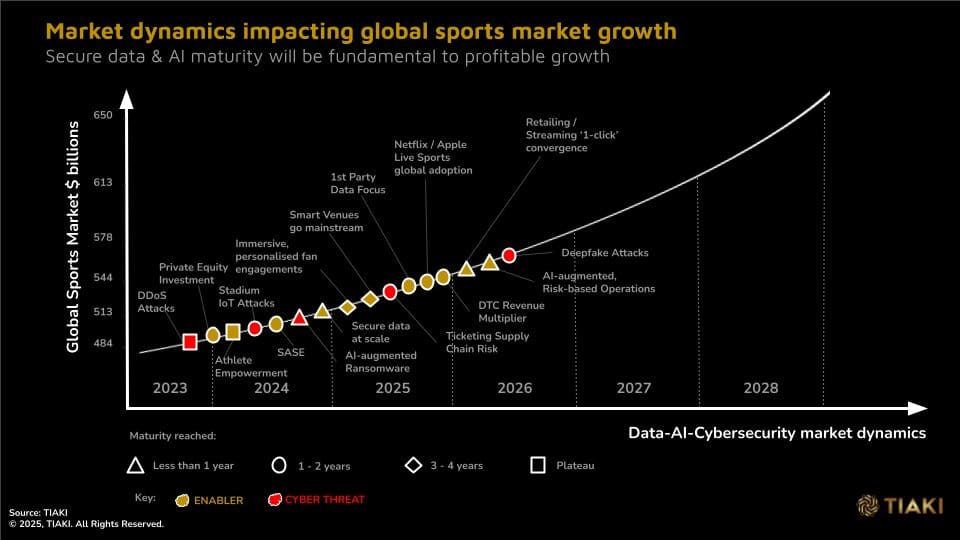

As sports properties accelerate their secure ‘data-at-scale’ ambitions and AI-augmented immersive fan experiences, the demand for private equity investment to fund technology transformation and stadium infrastructure ecosystem upgrades will continue to be highly relevant.

The shift to leverage digital and data is fueling the global sports market growth from 2024 onwards. CAGR growth is forecast to double from 2024 onwards, growing boldly at a consistent 6.1% CACR. Key market disruptors contributing to this sustainable growth include:

★ Sports properties rapidly improve their data maturity and network cybersecurity postures to become data centric organisations in order to monetise their 1st party data from their social media followers.

★ Digital immersive fan engagements and personalised AI-powered sports broadcasting

★ The market entry of Netflix and Apple platforms into live sports streaming hits mainstream across North American leagues (NFL, NBA, MLB, NHL, MLS) and Europe (soccer, cricket, rugby).

★ Connected smart venues with private 5G / WIFI 7 connected infrastructure ecosystems becomes mainstream at all sports properties to drive enhanced immersive fan experiences and new revenue streams.

Over a 14 year period, the global sports market will almost double from $360 billion in 2014 to $650 billion by 2028. High growth in the next 3 years is fundamentally driven by the pivotal shift to digital and secure data-at-scale.

Data centricity shifts to front and centre as media rights value plateaus

The sports industry is approaching an inflexion point where the over-reliance on media rights as the key driver for long-term revenue growth is waning. The market has reached a saturation point with its existing offerings and must now consider new data-driven digital levers and ecosystem partnerships for growth.

However, there are significant hurdles in the short term to achieve value creation due to the lack of data and digital maturity in the industry.

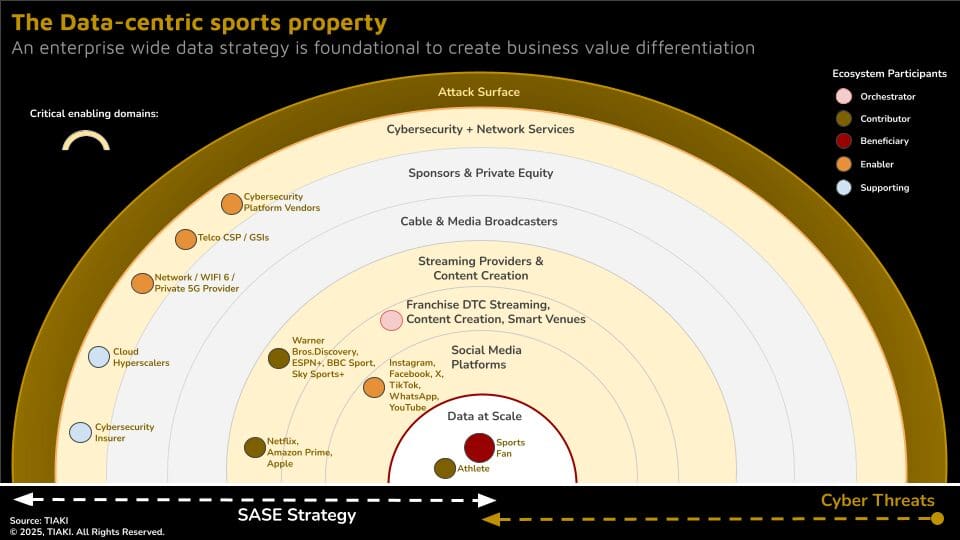

All actors in the dynamically changing sports value chain will need to become data centric organisations to compete ‘off the field’ in an increasingly crowded global marketplace for sports fan engagement and loyalty. ‘Secure data-at-scale’ will be paramount to even enter the race.

Winning the battle for customer lifetime value (CLV)

The primary digital sports fan relationship across Customer Lifetime Value (CLV) is a highly contested space. Traditionally, sports franchises, sports broadcasters, and sports sponsors have all played a significant role in engaging with fans digitally. The landscape is now shifting with the emergence of Netflix, Amazon Prime and Apple entering the market. They are all vying for fans’ attention and loyalty, and are looking for innovative ways to engage with them in a digital-first world.

The fundamental value lever is a deep, interactive, loyal relationship with sports fans to drive new monetisation and customer lifetime value (CLV) the sports digital ecosystem.

A pivotal shift is needed in the fragmenting global sports industry, otherwise irrelevancy will materialise. The future lies in dynamic content creation and secure data-at-scale which will reimagine unique value creation in the sports platform ecosystem.

Our analysis of North American franchises in the ‘big 4 leagues’ versus European football ‘big 4 giants’ indicates that 1st party data focused, CLV centric sports franchises have the potential to generate, on average, $835m more value in direct-to-consumer (DTC) revenues in the next 12 months, compared to a data immature club.

Sports properties need to become data centric organisations

Building an effective 1st party data strategy for digital fan growth is becoming foundational for success for leading sports franchises and clubs. One only needs to look at other sectors, such as Financial Services and Telco industries, to understand how they have spectacularly failed to develop deep meaningful, personalised relationships with their customers, despite sitting on vast quantities of transactional and location-specific conversation data. This reflects an inability to leverage data-at-scale from their legacy silos.

FC Barcelona remains one of the leading global football club brands on social media with 335 million followers. However, their recent €280 million sponsorship deal with Spotify failed to meet the music streaming brand’s expectations. The sponsorship collaboration provided Spotify with less than 1% of Barcelona’s followers in actual first party data for monetisation opportunities.

This highlights the reality gap which exists at many sporting organisations which is their inability to leverage 1st party data from their fan base of social media followers for monetisation and deeper, insightful engagement purposes. A customer lifetime value (CLV) centric mindset is not in place. This data immaturity is failing to meet expectations of fans, sponsors and private equity investors and also potentially undermines negotiation power in future sports media rights deals. Our earlier observations reinforce this reality:

★ 88% of C-suite sports executives admit they do not have a data strategy integrated into their business decision making1.

★ 50% concede to commercialising less than 10% of their known audience2.

The data challenge is broader than simply how to improve harvesting existing 1st party data. A retailing data-driven personalisation mindset is needed to leverage 1st party data with anonymised 2nd party data from global players such as Google Audiences and synthetic data generation to create large volumes of sports fan personas for algorithmic learning. Only then will highly accurate, hyper-personalization marketing campaigns become credible for targeting new potential sports fans and assisting in retaining and engaging existing fans.

Data-driven insights which enable the sports franchise to recognise, in advance, that a specific element of their fan base is at risk of disengagement, and then proactively address this with personalised campaigns to neutralise the churn risk, should become standard. This data-centric shift needs to be embraced quickly by the sports industry to drive stickiness, international growth and monetisation outcomes.

Secure data-at-scale becomes critical for success

Leading sports franchises and clubs are looking to redefine data-driven, digital fan experiences via their own platform ecosystems, own brand direct-to-consumer (DTC) streaming subscriptions and compelling content creation. This is fundamentally based on managing vast quantities of 1st party data and likely 2nd party and synthetic data volumes to create unique hyper-personalisation experiences to their existing and potential target sports fans.

Sports organisations will need to grow their data strategy maturity to have the correct governance and guard rails in place to deliver this ‘data-at-scale’. The challenge, however, does not stop here. Crucially, this data must be secure. Leading organisations are recognising this vital requirement and are now starting to deploy market best practice Secure Access Service Edge (SASE) solutions to minimise their cybersecurity data risk.

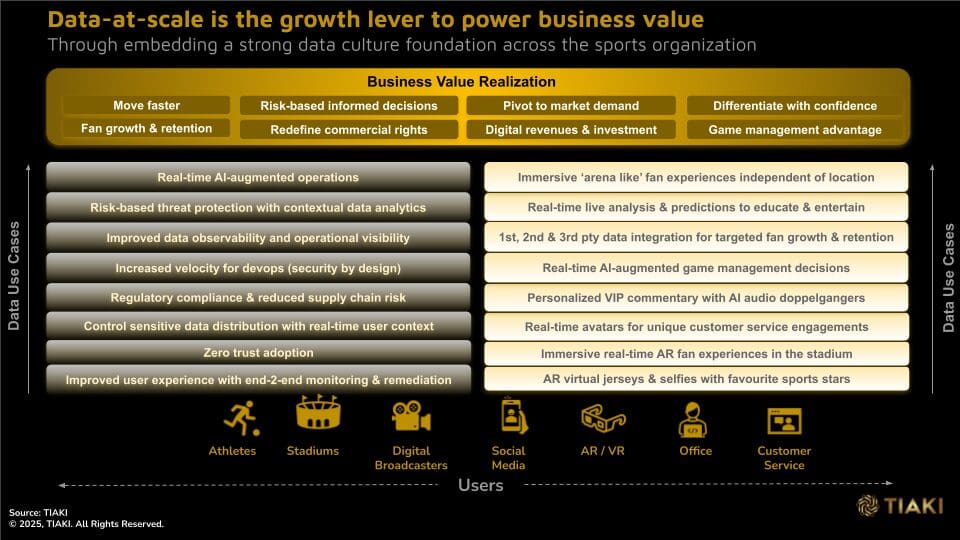

SASE accelerates business value realization for sports properties

Implementing a comprehensive SASE strategy across all aspects of a sports property organisation should not be regarded as a defensive, technology centric cost burden. With correctly deployed SASE use cases, it becomes a fundamental business enabler to catalyse revenue multiplier growth.

Below we highlight 4 business value realisation areas which benefits from a SASE data centric approach:

1. Move Faster – Pivot to Market Demand

With a robust network cybersecurity culture deployed, based on SASE, there is increased velocity for development teams to move quickly, with confidence, for their software development cycles. Security by design is embedded at the start of all development projects. This capability facilitates faster time to market and ability to pivot to latest and potentially disruptive new market demands from fans. This enables improved differentiation and competitiveness.

2. Risk-based Informed Decisions

SASE provides the foundation for secure data-at-scale across the whole organisation. With improved data observability and greater operational visibility, decision makers are able to make better, more-informed decisions impacting the business or the network or the infrastructure or the supply chain.

Shifting to risk-based threat protection with contextual data analytics provides for a more targeted, cost efficient approach to critical operations which improves the business case profile and profitability for business use cases.

Additionally, by removing historical data silos to create secure data-at-scale, there is a greater volume of data available for algorithms to provide AI-augmented decision making to improve the quality of operational decisions. This shifts human operational focus to high-end decision making and enables manual, commodity tasks to be automated. Further improving accuracy, whilst reducing risk and cost to the business. Leading adopters can look to achieve real-time AI-augmented operations as their future target state.

3. Differentiate with Confidence – Fan Growth and Retention

Shifting to a data-driven culture to drive hyper-personalised fan engagements and content creation is becoming critically important in the increasing crowded digital sports marketplace. The ability to grow 1st party data from highly targeted fan acquisitions globally and then continue to remain relevant to this fan base to avoid churn is becoming key for long term sustainable revenue growth.

To date, most sports franchises have struggled to effectively monetize their 1st party data assets across the customer lifetime value cycle. SASE will help to accelerate this pivotal shift by catalysing the secure deployment of data for:

★ Immersive ‘arena like’ fan experiences independent of location

★ Real-time live analysis and predictions to educate, entertain and continuously engage with fans

★ The integrated use of 1st party data with anonymised 2nd party data (Google Audiences), combined with 3rd party data and synthetic data to create highly accurate fan personas for personalised outbound fan acquisition and retention campaigns

★ Real-time avatars for unique digital immersive experiences and customer service engagement superior expectation delivery

★ Real-time fan augmented reality (AR) fan experiences in the stadium

Additionally, a correctly deployed holistic SASE deployment will ensure that all of the above are seamlessly integrated to continue to seamlessly deliver superior data-driven sports fan experiences.

4. Digital Revenues and Investment – Redefine Commercial Rights

Our analysis suggests that a data-centric approach with SASE can improve the conversion of social media fans to active, monthly payment subscription customers and improve the retention of these highly valuable loyal fans with deeper relationship engagements.

In particular, sports clubs and franchises in soccer and cricket have large global social media followers. The potential to convert these social media sports fans to monthly fee paying subscribers for unique content and direct to consumer (DTC) streaming services is enormous.

In Europe, there remains a malaise for sports properties in growing their income from broadcasting and sponsorship deals. Football clubs are now looking for alternative revenue sources such as increasing their matchday income through boosting fan attendance from stadium expansion upgrades3. Additionally, launching their own brand DTC streaming services and merchandising could also be highly lucrative with a data-centric 1st party approach.

Retaining a large footprint of fee paying sports fans fundamentally changes the negotiation dynamic in future commercial rights deals. Without credible 1st party data assets, sports properties have a weakened position in the dynamically changing sports value chain, particularly with increasing buying power of Netflix, Apple and Amazon Prime.

AI-augmented cybercriminals smell opportunity in private equity invested sports franchises with billion dollar rights deals

As the AI-augmented cybercriminals ramp up the volume and complexity of their data breach attacks, the cyber threat and consequential risks to new 2024 sporting business models have never been higher. The industrialisation of the cybercriminal ecosystem has created a 79% increase in ransomware attacks in the last 12 months4. More worryingly, the complexity and speed of the attacks are increasing significantly due to the deployment of AI tools by the cybercriminal.

The cybercriminals are opportunistic. They hunt for soft targets that are digitally and data immature, where there is significant investment from private equity and sports rights stakeholders to justify the criminals’ demands for high ransomware payouts following a data breach theft. The NBA’s $76 billion and NFL’s $111 billion sports rights deals, with increasing amounts of private equity investment and an explicit business goal to target data-driven fan growth in international markets, demonstrates exactly why the sports industry is becoming an increasingly attractive target for ransomware data breach attacks.

The cybercriminals are now ‘AI-weaponised’ to attack enterprises that have failed to put robust network cybersecurity postures in place. The cost of a data breach is significant. Our research suggests $6.1 million was the average cost of an enterprise data breach in 2022 based on 200 selected enterprises with high-end monitoring 5. In addition the risk of unrepairable brand damage for the sporting entity, the loss of trust from sporting fans and athletes from the theft of their personal data, and the exit of sponsors and investors, could quickly create an untenable, unrecoverable business.

The C-suite can pivot confidently to new data-driven business models with an effective SASE strategy

A SASE strategy is fundamental in reducing cybersecurity risk by ensuring C-suite ownership and awareness on the risk to the business. It is crucial to increase top-level buy-in to address the evolving cybersecurity threat landscape, especially with the transition to digital enterprise and next-generation technologies. Many sporting organisations are ill-prepared to respond to the evolving AI-augmented threats, including 3rd party supply chain risks, necessitating the need for the C-suite to elevate network cybersecurity as a senior leadership priority.

By making SASE and network cybersecurity a board-level agenda item, with proper oversight and governance, companies can align their leadership, their investment priorities and commit to enhancing digital resilience against the AI-augmented cybercriminal risks, including supply chain risks, through improved cybersecurity capabilities and gap identification.

This strategic alignment and prioritisation of risk-based controls, based on business understanding, are essential components of a SASE strategy to effectively manage network cybersecurity risks whilst enabling monetisation of creative content and data assets.

Conclusion:

SASE enables secure data-at-scale to power revenue growth

In today’s digital, data-driven economy, sporting organisations will continue to accelerate cloud-native ecosystems and GenAI adoption as they seek new digital revenue streams, invest in innovative hyper-personalised engagements with sports fans, upgrade stadium physical infrastructure to digital ‘smart venues’, and pursue athlete competitive advantage.

This will fundamentally transform the way coaches, athletes, journalists, and fans experience sport in the next 2 years. Secure ‘data-at-scale’ will be the ‘lifeblood’ of this new sporting reality.

The criticality of a robust network cybersecurity posture to protect against the cybercriminal and enable ‘data at scale’ for new monetisation opportunities, is not yet fully recognised, which is creating significant business risk. This risk can be reduced with an effective SASE strategy.

However, implementing a comprehensive SASE strategy across all aspects of a sports property operating model should not be regarded as a defensive, technology centric cost burden. With correctly deployed SASE use cases, it becomes a fundamental business enabler to catalyse revenue multiplier growth.

An effective SASE strategy provides the mechanism for sports properties to:

★ To operate faster ahead of the competition with increased velocity for sports property software development teams

★ Shift to risk-based, AI-enabled decision making to improve accuracy whilst reducing risk and costs

★ Differentiate digital fan engagements with bold, confidence to drive more effective fan acquisition and retention campaigns with improved ROI

★ Create secure, 1st party data new digital revenue streams enabling rights holders to redefine their commercial rights negotiation dynamics with sports broadcasters and sponsors.

By shifting to become data-centric, content-generating operations, sports properties have seemingly limitless creative possibilities to reimagine personalised, relevant shared experiences for their existing and prospect digital sports fans across the globe. Data-at-scale is the lifeblood of these pioneering new ambitions. SASE adoption will ensure this data is secure for revenue growth and value creation.

1 Only 2% of UK sports properties expecting major media rights growth in next five years – SportsPro (sportspromedia.com)

2 Only 2% of UK sports properties expecting major media rights growth in next five years – SportsPro (sportspromedia.com)

3 Premier League clubs plan ‘14%’ stadium capacity growth to boost matchday income – SportsPro (sportspromedia.com)

4 Orange Cyberdefense Executive Navigator 2024: Research-based cybersecurity insights to drive smart business decisions

5 Orange Cyberdefense Security Navigator Report 2024: Research-based cybersecurity insights to drive smart business decisions

About the Author:

David Andrew

Founder & Managing Partner

www.tiaki.ai

david.andrew@tiaki.ai

David is the Founder & Managing Partner at TIAKI, a niche consulting practice helping executive leadership in sport make confident, informed decisions on their risks, investments and business outcomes powered by secure ‘data-at-scale’. He collaborates with bold and determined leaders in the sports ecosystem to define their data, AI and cybersecurity strategies to deliver sustainable value.

David’s vision for TIAKI is to empower sports franchise CEOs, leadership teams, sports media broadcasters and investors in the global sports industry with strategic advisory frameworks to deliver secure, pioneering digital fan experiences and new ecosystem business models to achieve breakthrough returns.

David has over 20 years of strategy and technology enabled business transformation experience, providing consulting expertise in cloud native technologies, data strategy, digital business enablement and cybersecurity strategy. He is passionate about helping talented leadership teams succeed in securely growing their differentiated business models in the data-driven, digital sports economy.

Based in Stockholm, David previously worked for IBM Consulting, EY, Accenture Strategy and Orange Business. He studied Chemistry at Durham University and holds an MBA from Trinity College, Dublin Business School.

Copyright © 2025 TIAKI.

All rights reserved. TIAKI and its logo are registered trademarks of TIAKI.

Search